Amazon seller insurance is not compulsory for sellers, but having it’s a really good idea. Amazon can help cover costs of up to $1,000 for certain problems, but only if you follow their rules and have the right insurance. If something happens that costs more than $1,000, your own insurance has to pay for it. That’s why Amazon says sellers who make $10,000 in sales for three months in a row must have seller insurance.

It might seem a bit complicated at first, but getting insurance for your online store isn’t as tough or expensive as you might think. In this article, we will break it down into details for easy understanding. Read this, and you can learn:

- Why do you need Amazon selling insurance?

- What are Amazon seller insurance requirements?

- What type of Amazon seller business insurance do you need?

- Where to find Insurance on Amazon?

- How much does Amazon seller insurance cost?

- How do you upload insurance to Amazon?

Let’s check it now!

Why Do You Need Amazon Selling Insurance?

As mentioned, if you’re an Amazon seller with a Pro Merchant account making over $10,000 monthly for three consecutive months, you need Amazon seller insurance. Once you hit that mark, you have 30 days to show Amazon your insurance certificate or your account could be suspended. Why does Amazon have these insurance requirements? Amazon has these requirements to reduce its risk if something sold on its platform leads to harm or property damage.

#1 – Protect from lawsuits

The first and most obvious reason why you should have Amazon insurance is lawsuit protection. And here’s the breakdown:

- Unexpected defects: Even well-made products can have unforeseen defects. Manufacturing errors, faulty materials, or issues during design can all lead to products causing harm.

- Improper use or labeling: Not all product liability claims are due to defects. Sometimes, customers misuse products or misunderstand labeling instructions. Imagine you sell a powerful cleaning solution. If the label isn’t clear or a customer uses it incorrectly, leading to an injury, you could be held liable for not providing adequate warnings.

- Third-party products: Even if you source your products from a reputable manufacturer, you can still be held responsible for issues. This is because you’re the one selling the product on Amazon.

If you’re still unclear about how Amazon seller insurance protects from lawsuits, here is an example:

Let’s say you sell a portable baby food heater on Amazon. The heater is advertised as safe and convenient. Unfortunately, due to a faulty wiring issue, the heater malfunctions and overheats, causing a fire in a customer’s home. The fire injures a child and damages the customer’s property. In this situation, you could face multiple lawsuits:

- The parents of the injured child could sue you for medical expenses and emotional distress.

- The homeowner could sue you for property damage caused by the fire.

Without product liability insurance, you’d be responsible for covering all these legal costs yourself. This could potentially bankrupt your business. However, if you have Amazon seller insurance, the insurance company would step in and handle the lawsuits on your behalf. They would cover legal fees, settlements, and any judgments up to the policy limits.

#2 – Mandatory insurance for high-volume sellers

As your sales on Amazon increase, so does the potential risk of product liability issues. To mitigate this risk for both the seller and Amazon itself, Amazon requires sellers with Pro Merchant accounts exceeding $10,000 in monthly sales for three consecutive months to have commercial general liability (CGL) insurance.

Here’s what I illustrate how it works:

Imagine you’re a seller who manufactures and sells phone cases on Amazon. Your business is booming, and you consistently exceed $10,000 in monthly sales. Unfortunately, a customer filed a lawsuit claiming that your phone case caused their phone to overheat and malfunction. This could result in a product liability lawsuit for damages to the phone and any potential data loss.

Why does Amazon require insurance in this scenario?

- Protection for Amazon: If Amazon didn’t require insurance, and you lost the lawsuit, they could be held partially liable for allowing the sale of a potentially defective product. Insurance ensures they’re not financially responsible for such claims.

- Protection for the Seller (You): The lawsuit could be incredibly expensive, involving legal fees, potential settlements, and even damage to your brand reputation. Having CGL insurance would cover these costs and help you stay afloat financially.

By requiring insurance, Amazon creates a safer marketplace for both sellers and customers. Sellers are less likely to face financial ruin from lawsuits, and customers have some recourse if a product causes harm. It’s a win-win situation.

#3 – Peace of mind

Lastly, Amazon sellers having insurance don’t have to worry about running a business, especially when it involves potential liability for the products they sell. Here’s a more specific example to illustrate this point:

When you’re selling handmade wooden toys (for example) on Amazon.

You take pride in the quality and safety of your products, but even the most meticulous crafter can’t guarantee every single toy will be absolutely perfect.

Here’s where peace of mind from insurance comes in:

- Without Insurance: Imagine a customer contacts you, claiming their child swallowed a small piece that broke off one of your toys. You’re worried sick about the child’s health and the potential legal ramifications. The fear of a lawsuit and its financial consequences can be overwhelming, impacting your ability to focus on your business and potentially causing sleepless nights.

- With Insurance: Having product liability insurance provides peace of mind. In this scenario, you know your insurance can help cover the costs associated with the incident. The insurance company would likely handle communication with the customer and their lawyer, working towards a resolution. This allows you to focus on supporting the child’s recovery and ensuring the safety of your products without the constant burden of financial worry.

Even if the lawsuit ends up being unfounded, the legal process itself can be stressful and time-consuming. Insurance helps alleviate this burden by providing legal representation and managing the situation on your behalf.

What are Amazon Seller Insurance Requirements?

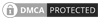

The Program Policy help page on Amazon outlines Amazon seller insurance requirements that sellers must adhere to. Your Amazon seller insurance policy needs to fulfill the following requirements:

- Your insurance policy needs to cover all business liabilities, such as bodily injury and product operations, with a minimum coverage of $1 million per incident.

- Your policy options include commercial general, umbrella, or excess liability insurance, but it must be written on an occurrence basis.

- Your insurance provider must be capable of handling claims globally and should hold a strong financial rating, such as S&P Aor AM Best A-. Alternatively, an equivalent rating from your country is acceptable.

- If your insurance provider makes changes to or cancels your policy, they must notify Amazon at least 30 days beforehand.

- The policy should name Amazon and its affiliates as additional insured parties.

- Your policy’s deductible should be $10,000 or less and clearly stated in the certificate(s) of insurance.

- It must cover all sales made through products listed on the Amazon website.

- Your insured name should match the legal entity name provided to Amazon, which is visible on your Account Info page.

- You are required to complete and sign the Amazon seller insurance policy.

- The Amazon selling insurance should remain valid for at least 60 days from the submission date.

In short, if your monthly sales exceed $10,000, you should have Amazon seller insurance covering at least $1,000,000. Even if you’re starting small or haven’t reached this sales threshold yet, it’s wise to have insurance. Accidents can happen with any product you sell, and not meeting Amazon’s threshold doesn’t exempt you from liability if a customer gets hurt.

What Type of Amazon Seller Business Insurance You Need?

Let’s discuss the usual types of Amazon seller liability insurance that sellers often use to protect themselves from the common risks of selling on Amazon.

Keep in mind: Amazon only demands you to have Commercial General Liability insurance at least. The other ones mentioned are for particular situations.

Commercial General Liability (CGL)

You need to have Commercial General Liability (CGL) insurance with the following minimum limits:

- $1,000,000 per single incident;

- $1,000,000 for products and completed operations combined;

- $1,000,000 in total for all occurrences.

This Amazon seller insurance should cover product liability, products/completed operations, bodily injury, personal injury, broad-form property damage, and broad-form contractual coverage.

The key point is that Commercial General Liability insurance primarily protects your business from product-related risks, including three main aspects:

- Bodily injury: This covers medical bills and legal expenses if someone gets hurt.

- Property damage: It includes the expenses to repair or replace others’ damaged property, along with legal fees.

- Legal fees: CGL insurance assists in covering the costs of defending against product liability claims in court.

Several Commercial General Liability policies might additionally include coverage for advertising injury. This entails claims about copyright infringement or the unauthorized use of advertising concepts.

Excess Liability

Excess liability insurance helps you cover the claim exceeding the limits of your primary policy.

You might want to think about getting Excess Liability insurance for your Amazon business in these situations:

- If your current insurance policy doesn’t meet Amazon’s coverage standards.

- If you’re selling a high-risk product that carries substantial liability risks.

For example, there’s a major incident, and the total claim against you amounts to $1.5 million. Your primary Amazon seller insurance covers the first $1 million, but you still have $500,000 left to cover. Excess liability insurance covers this extra $500,000, ensuring you’re not left financially exposed beyond your primary policy’s limits.

Think of it like adding an extra layer of protection on top of your primary insurance, just in case you face a large claim that exceeds your primary policy’s coverage. Remember, you need to purchase excess liability insurance separately for each primary policy you want to extend, as it’s designed to complement specific primary policies.

Umbrella Insurance

Umbrella insurance is like a big safety net for your business. This Amazon seller insurance adds extra coverage to your existing insurance policies, all in one package. With just one umbrella policy, you can boost your coverage for things like general liability, commercial auto, and worker’s compensation simultaneously.

For instance, a customer may file a lawsuit claiming injury from one of your products, or your inventory gets damaged during shipping. And the costs exceed the limits of your primary policies. In this situation, umbrella insurance steps in to provide additional financial protection for your Amazon eCommerce business.

It’s like having one giant umbrella that shields you from various risks across your business activities.

Where to Find Insurance on Amazon?

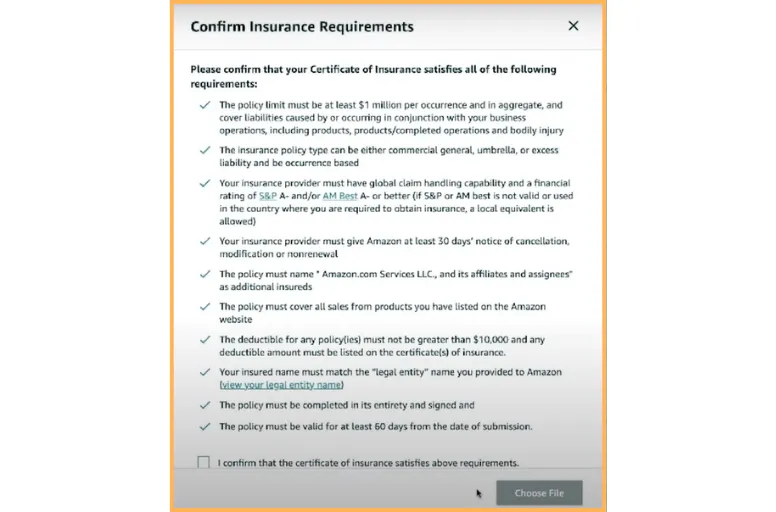

Amazon offers a quick insurance solution for sellers called the Amazon Insurance Accelerator program. This program makes it simpler and cheaper for sellers who wonder how to get insurance on Amazon. Amazon has teamed up with Marsh to connect sellers with trusted insurance providers. This way, sellers can easily get insurance quotes and get coverage fast.

Below are some insurance companies that specialize in working with Amazon and eCommerce sellers:

- Chubb;

- Harborway Insurance underwritten by Spinnaker Insurance Company;

- Hiscox;

- Liberty Mutual Insurance;

- Markel and Travelers;

- Bold Penguin;

- Simply Business, Inc.;

- Next Insurance.

The advantage of choosing the Amazon seller insurance companies mentioned is that they possess expertise in understanding the specific insurance needs of Amazon sellers.

How Much Does Amazon Seller Insurance Cost?

How much is Amazon seller insurance? Amazon sellers’ estimated annual revenue typically determines the cost of insurance at Amazon. Rates can fluctuate but generally range from 0.25% to 1% of annual total revenue. On average, sellers can expect to pay from $500 to $2,000 a year. However, some providers offer policies for as low as approximately $300 annually.

Here are several factors that Amazon seller insurance companies consider to decide your insurance costs:

- Product types: Insurance companies assess the risk associated with your product. Selling a high-risk product? This can lead to higher premiums.

- Insurance type: The specific type of insurance policy you choose also impacts your premiums. More comprehensive policies like umbrella insurance tend to have higher premiums than standard commercial general liability policies.

- Revenue: Insurance providers also consider your business’s annual revenue. As your revenue increases and your business grows, your premiums will likely rise accordingly.

How to Upload Insurance to Amazon?

After purchasing an Amazon seller insurance, the next step is to upload your Certificate of Insurance (COI) to Seller Central. You can request this certificate from your insurance provider. To streamline this process, you can reach out to the insurance companies listed in Amazon’s Insurance Accelerator program. Additionally, you can contact Marsh, a global insurance broker specializing in assisting international sellers in obtaining the necessary insurance coverage.

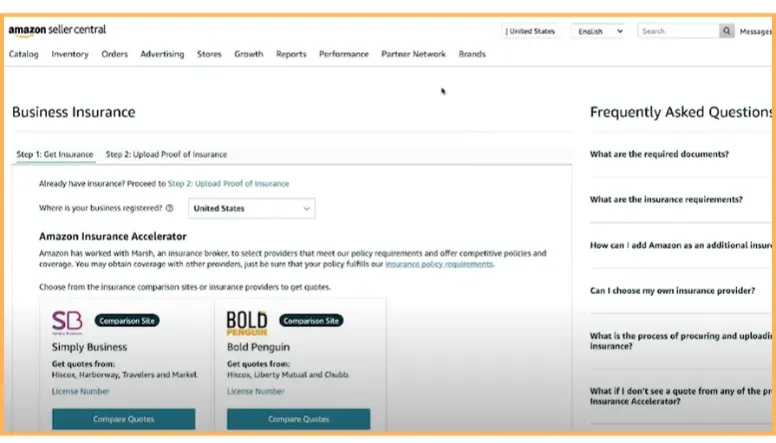

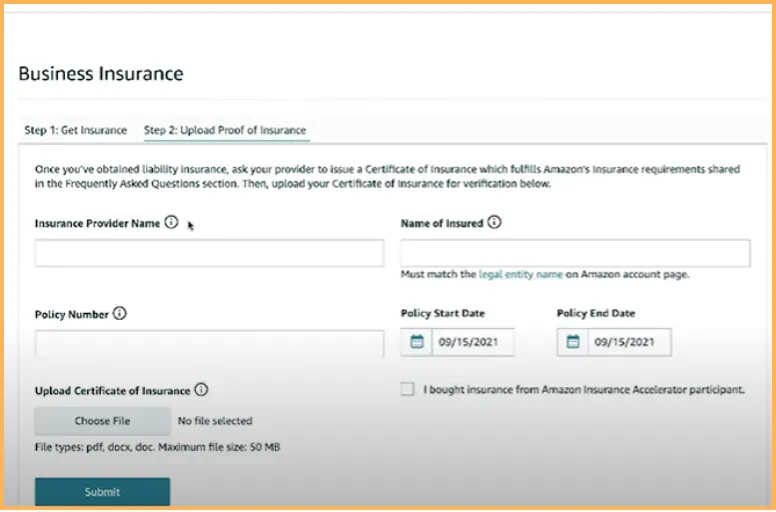

Here is how you can upload insurance to Amazon:

- Step 1: Go to Seller Central > Settings > Account Info > Business Insurance. The business insurance page has a list of insurance providers.

- Step 2: Complete the required fields, including your insurance provider’s name, the insured’s name (which should match the legal entity name on your Amazon account), the certificate number, and the start and end dates of the insurance coverage.

- Step 3: If you purchased insurance through the Amazon Insurance Accelerator program, check the corresponding box.

- Step 4: Upload your proof of insurance certificate.

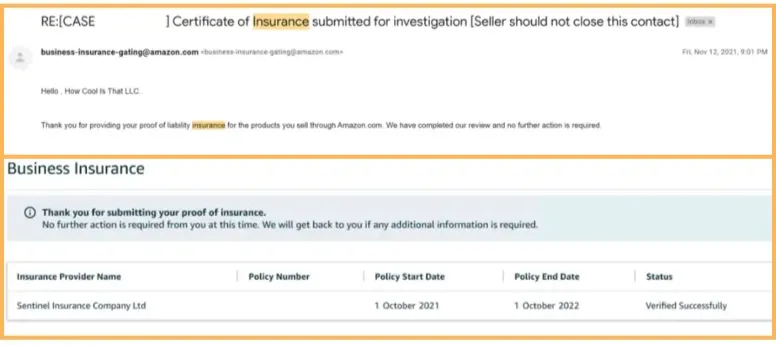

- Step 5: Once you’ve filled in all the necessary information, submit it. You’ll receive confirmation that your submission has been received, and your status should show as “Submitted.”

If you want to a physical copy of the insurance certificate, you can mail it to:

Amazon – P.O. Box 81226 – Seattle, WA 98108-1226

Once you’ve sent the COI, it will be uploaded to your Amazon seller account and undergo review. If the information provided is accurate and meets Amazon’s requirements, your certificate will be accepted.

Amazon Seller Liability Insurance: FAQs

Amazon offers assistance covering costs up to $1,000 for certain issues, provided sellers adhere to their guidelines and have the appropriate insurance. However, if the incurred costs exceed $1,000, sellers are responsible for covering those expenses through their own insurance coverage. There are numerous options for Amazon seller insurance, and the best way to discover the ideal policy for your enterprise is by contacting insurance providers and requesting quotes. Additionally, Amazon helps sellers navigate insurance choices through its Amazon Insurance Accelerator program. You can select an appropriate insurance company there. Based on our recent knowledge, notable companies for Amazon liability insurance include: If you are a professional seller on Amazon and generate gross sales of $10,000 or more per month for three consecutive months, Amazon requires you to obtain business insurance. Conversely, if you do not meet these criteria, you don’t need Amazon selling insurance to sell on the platform. Amazon’s insurance policies may have different refund policies with specific terms and conditions. Some insurance policies may allow for refunds within a certain period after purchase, while others may not offer refunds at all or have specific conditions for eligibility. You should carefully review the policies and consult with the Amazon seller insurance provider directly.

Protect Your Business with Amazon Seller Insurance

Having Amazon seller insurance is vital for protecting your business and achieving success on the platform. With the eCommerce marketplace evolving, there’s a heightened risk of consumer lawsuits, making it essential to shield your business. Ensure you have Amazon product liability insurance, and regularly review and adjust your policy to align with your product offerings and business needs.

If you want to find a more helpful guide for Amazon sellers like this one, visit our Blog now. LitCommerce support team also works around the clock to support any customer reaching out to us, so don’t hesitate to contact us anytime you have questions related to eCommerce.