Yes, Amazon updated its return policy in June 2024. The biggest change is a return processing fee for some products with high return rates. This doesn’t apply to clothes and shoes, but other categories may incur a fee if many customers return them. This guide comprehensively explores Amazon return policy change. We’ll also explore potential benefits and challenges for sellers and provide actionable tips for navigating the evolving landscape.

Expand Your Sales Beyond Amazon!

Don’t let Amazon’s strict return rules limit your growth. Use LitCommerce to list your products on multiple channels like TikTok, Etsy, and Shopify – and sell more!

Overview of Amazon Return Policy Before Changing?

Before the changes in 2024, Amazon’s return policy had several key points:

- Return window: The general return window for most items on Amazon was 30 days from the delivery date. However, there were exceptions and different return policies for certain product categories and special cases:

- Exceptions: Live plants or insects, prepaid phone cards, digital products (unless otherwise specified), and theme park tickets.

- Items with a different return window:

- Baby items (90 days)

- Birthday gifts from Baby Registry (365 days)

- Amazon Renewed items (90 days)

- Mattresses (100 days)

- Wedding registry gifts (180 days)

- Products with specific return requirements:

- Collectibles (must be returned with tracking and insurance for high-value items)

- Fine art (must be returned with tracking and insurance for high-value items and original documentation)

- Jewelry and watches (must be returned with original documentation and packaging)

- Luxury stores (must be returned unused and in original packaging with all tags and accessories)

- Software and Video Games (restocking fee up to 100% if opened or used)

- Televisions (must be returned in original packaging with all personal data removed)

- Items containing hazardous materials (Specific packaging guidelines provided by Amazon should be followed for safety.)

- Condition of the item: When returning an item, it was important to ensure that it was in its original condition and packaging. Items should be returned in the same condition as they were received, with all accessories and components included.

- Seller discretion: Sellers had the ability to dispute returns they believed were not valid through their seller account. They could provide evidence to support their dispute, such as photos of the product before it was shipped.

- FBA inventory evaluation: When a product was returned, an Amazon employee would inspect the item to determine its sellability. Sellers did not have the option to automatically return or dispose of unsellable inventory in Seller Central

- Returnless refunds: Returnless refunds were available, but sellers did not have the ability to specify returnless refund rules in Seller Central. Returnless refunds were handled by Amazon without the seller’s approval.

What Are Amazon Return Policy Changes in 2024?

In 2024, Amazon introduced several key changes to its return policy that sellers need to be aware of. The most significant point of Amazon return policy change is the introduction of a returns processing fee for products with high return rates.

But, there’s more to Amazon return changes than processing fees. So, this guide delves into the details of the new return policy, including the returns processing fee structure, the standard return window, returnless refunds, and FBA inventory evaluation settings

1. Returns processing fee

This is the most significant Amazon changing return policy for sellers in 2024. Implemented in June, a returns processing fee applies to products with a high return rate across all categories except apparel and shoes. This fee is intended to offset the operational costs associated with processing returns and minimize waste.

Breakdown of return processing fee policy

As the main part of Amazon return policy change, the return processing fee policy includes many points sellers need to know:

- The fee considers product returns over a three-month period starting from the shipment month. For example, for products shipped in June, returns will be tracked through June, July, and August

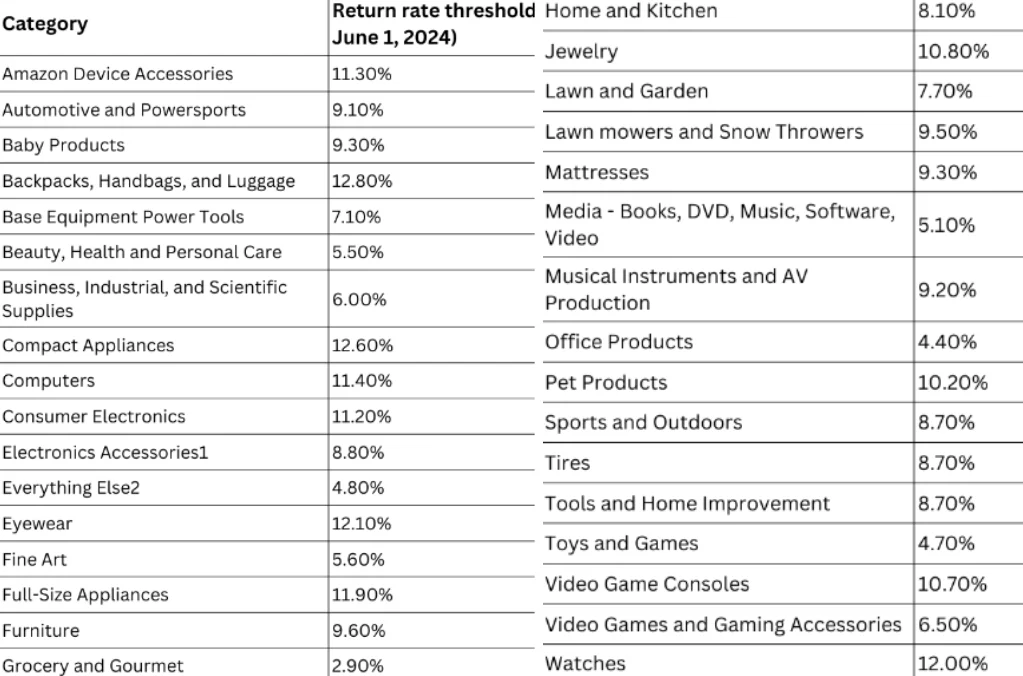

- Amazon has set specific return rate thresholds for different product categories, ranging from 2.9% to 12.8%. Any product falling outside these categories will be considered under the “everything else” rate of 4.8%.

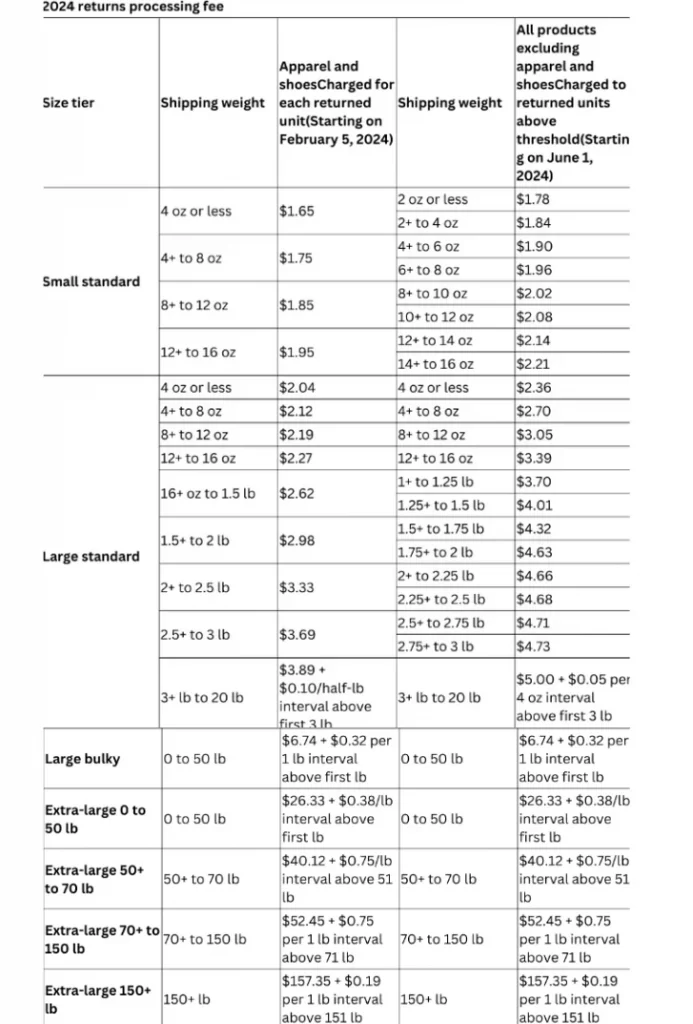

- In case the return rate of your product goes beyond the threshold, you will incur a fee for each unit that surpasses the threshold. The fee is determined by considering the size tier and shipping weight of the product. As the product’s size and weight increase, the fee also increases. For products weighing over 3lbs, the fee becomes variable and is based on weight intervals specified by Amazon:

- Low-volume products (less than 25 units shipped monthly) and those enrolled in the “New Selection” program (up to 20 units per ASIN) are exempt from these fees.

Example of returns processing fee

Let’s say that you sold 1,000 board games in a particular month. The category return rate threshold for board games is 4.70%. This means that if your return rate for board games is below 4.70% of total sales, you won’t be charged a return processing fee. The return processing fee for your product size tier is $1.84 per returned unit.

Here is a summary:

- Product: Board bames

- Category return rate threshold: 4.70%

- Product size tier fee: $1.84

- Returned units: 30

- Units sold: 1000

Now, we have:

Return Rate = 50 units / 1,000 units * 100% = 5%

Since 5% is greater than the threshold (4.70%), some units will be charged the fee.

We need to find the number of units that exceed the threshold (category return rate x total units sold:

Units Exceeding Threshold = 4.70% * 1,000 units = 47 units

The fee applies only to units exceeding the threshold, here are formula:

Fee amount = Units exceeding threshold * product size tier fee

In this example, Fee Amount = 47 units * $1.84/unit = $86.28

Tool to support seller

To help you avoid return processing fees, Amazon has improved its Return Insights tool. This tool shows you:

- How many of your products are being returned and what percentage that is.

- The minimum return rate for your product category that triggers the fee.

- How many returns are above that limit and will be charged a fee.

You can access this tool on the FBA Returns page. Here’s how the fee works:

- Amazon will track returns for three months

- You will only be charged if the total number of returns for that month is higher than a specific limit set for your product category (you can find these limits on the Returns processing fee page).

- The fee applies to each returned item that goes above the limit.

2. Returnless refunds

Coming to the next part of Amazon return policy change, this giant gave sellers more control over returnless refunds.

Sellers can specify Returnless refund rules in Seller Central based on criteria such as price range, product category, return reason, and return window. This allows sellers to offer returnless refunds for specific situations where it makes business sense.

Managing refunds effectively is one of the key factors in winning the Buy Box and boosting your sales. Check out this guide for more tips on how to win the Buy Box

3. New FBA inventory evaluation settings

Previously, when a product was returned, an Amazon employee would inspect the item to determine its sellability. However, the 2024 Amazon return policy changes now allow sellers to change their FBA inventory evaluation settings in Seller Central. This means that sellers can now request that Amazon automatically return or dispose of their unsellable inventory in Seller Central

4. Standard return window

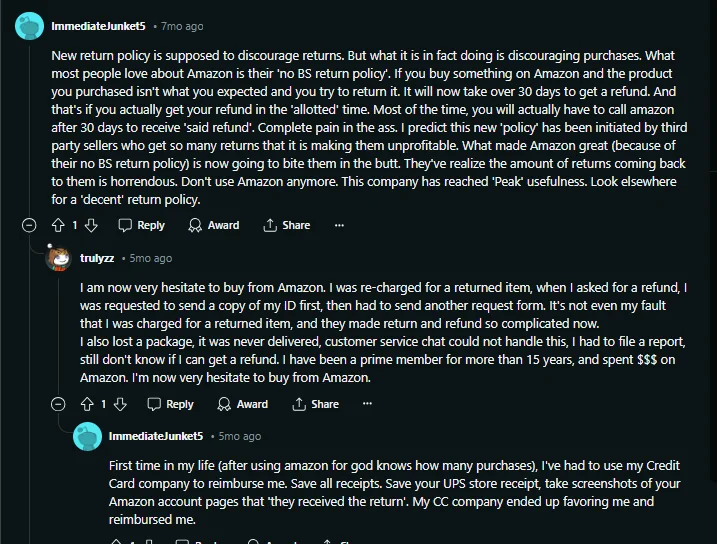

Actually, this is not officially mentioned in the statement of Amazon return policy change in 2024, but it is recognized by Amazon users themselves.

Some users have reported experiencing delays or difficulties with obtaining refunds beyond the 30-day mark.

Major Impact of Amazon Return Changes on Its Sellers

Amazon return policy change updates present both advantages and challenges for sellers. Here’s a breakdown of the key impacts:

Go Multichannel, Sell More!

Tired of limits? Use LitCommerce Amazon Integration to reach buyers on multiple platforms while keeping products and inventory fully synced.

1. Potential benefits

The new Amazon return policy offers several potential benefits for sellers, with the most significant ones being:

1.1. Reduced return costs

The primary driver for the introduction of return processing fees is to incentivize sellers to provide accurate product descriptions and improve their overall fulfillment process. By reducing unnecessary returns, sellers can expect to see a decrease in the associated costs.

These costs include the actual refund issued to the customer and the processing and restocking fees incurred when a returned item is deemed unsellable. For sellers with historically high return rates, these fees could represent a significant financial burden.

1.2. Greater control over the FBA Inventory

Amazon return policy 2024 also includes new FBA inventory evaluation settings that give sellers more control over unsellable returned items. With the option to automatically return or dispose of these items, sellers can save valuable time and resources compared to the previous, more cumbersome process. This increased control can lead to more efficient inventory management and lower operational costs.

2. Streamlined returnless refund

Another notable benefit of Amazon’s return policy change is the streamlined process for returnless refunds. This approach offers a faster and more efficient returns process for both sellers and buyers. By setting clear criteria in Seller Central, sellers can manage these refunds efficiently, potentially improving customer satisfaction. This process can reduce the logistical burden on sellers and enhance the overall customer experience by resolving issues more quickly.

3. Potential challenges

Nonetheless, Amazon return policy change 2024 also comes with some potential drawbacks for sellers, such as:

3.1. Potential for reduced profit margins

While introducing returns processing fees aims to incentivize lower return rates, it also adds an additional cost consideration for sellers. Products that surpass the undisclosed return rate threshold may incur higher fees, potentially reducing profit margins.

3.2. Buyer confusion regarding the standard return window

There have been reports of delayed refunds or difficulties with the return process, which can create frustration among buyers. This negative experience can impact the seller’s reputation and lead to lower customer satisfaction.

Quick Tips for Sellers Adapting to Amazon Return Changes

The 2024 Amazon return policy change has introduced a wave of both opportunities and challenges for sellers. So, we will suggest some actionable tips to help you navigate the evolving landscape:

1. Review product categories

The undisclosed return rate threshold that triggers the returns processing fee creates uncertainty. However, you can still be proactive with some actions:

- Start by closely examining your product categories and identifying those with a historically high return rate.

- Look for trends within your own listings and research common return reasons for similar products. This will help you prioritize resources and efforts.

For example, let’s say you sell various products, including electronics and clothing. By analyzing return data, they may find that electronics have a 15% return rate, while clothing only has a 5% return rate. This insight allows them to allocate resources more efficiently, perhaps offering extended warranties on electronics while implementing a more lenient return policy for clothing.

2. Consider offering free returns

While offering free returns can incentivize purchases and potentially reduce returns due to buyer hesitation, it’s important to weigh the cost-benefit carefully. Consider the average profit margin for your products and factor in the potential returns processing fee.

Free returns might be a good strategy for specific products with a low historical return rate or high perceived value. This can improve conversion rates and potentially lead to increased overall profitability. For instance, imagine you sell high-end designer sunglasses. These have a lower historical return rate and a high perceived value. Offering free returns can incentivize potential buyers who might be hesitant due to concerns about fit or style.

3. Maintain transparent return policies

Clearly outlining your return policy on your product listings is crucial to manage buyer expectations. You should ensure it’s easily accessible and includes details such as the return window, accepted return conditions (e.g., unworn, unwashed, with tags attached), and any restocking fees (if applicable).

Providing excellent customer service throughout the return process is equally important. Respond promptly and professionally to return requests, offering clear instructions and facilitating a smooth return experience. A positive return experience can go a long way in retaining customer loyalty.

For example, you sell backpacks. Clearly state your return policy on your product listings. Specify the return window (e.g., 30 days) and accepted return conditions. Additionally, within Seller Central, set up automated return messages to acknowledge return requests promptly and provide clear instructions on how to proceed.

4. Evaluate return data

Regularly analyzing your return data is a powerful tool to adapt to Amazon Prime return policy change. Looking for recurring reasons for returns within specific product categories or timeframes is important. By understanding the root causes of returns, you can implement targeted solutions to minimize their occurrence in the future.

For example, if you see a high return rate for a specific clothing item due to sizing issues, consider offering a more detailed size chart or including fit recommendations in the product description. This can help buyers choose the correct size the first time around, reducing the need for returns.

Amazon Return Policy Change: FAQs

Yes, Amazon updated their return policy in 2024. The most significant change is a returns processing fee for sellers with high return rates (except clothing and shoes). There’s also uncertainty around the exact return rate threshold that triggers the fee. Amazon hasn’t eliminated free returns entirely, but their policy has changed for sellers. There are still free returns for buyers, but sellers with high return rates (except clothing and shoes) face a new returns processing fee implemented in 2024. This fee incentivizes sellers to offer free returns strategically or focus on minimizing returns. The key changes to Amazon’s return policy affecting sellers rolled out in June 2024. This includes the introduction of returns processing fees for sellers with high return rates (excluding clothing and shoes). While the exact return rate threshold triggering the fee remains unknown, it’s crucial for sellers to be aware of this update.

Final Words

In summary, regarding Amazon return policy change, there are some points you need to keep in mind:

- Sellers with high return rates (except apparel and shoes) will incur fees to return processing costs. The exact return rate threshold for the fee is undisclosed.

- You can now choose to automatically return or dispose of unsellable items through FBA inventory evaluation settings.

- It is possible to set criteria for returnless refunds in Seller Central

- Return processing fees can add extra costs for sellers

Finally, don’t forget to follow our blog to receive the latest and most useful information about eCommerce words. Or if you have any questions related to our services, contact us for answers!