As the tax season approaches, it’s crucial for US-based Amazon sellers to note the upcoming deadlines. Partnerships, LLCs, or S corporations taxed as partnerships must file taxes by March 15, 2024. LLCs taxed as corporations, single-member LLCs, C corporations, individuals, and sole proprietors have until April 15, 2024, to fulfill their tax obligations. Amazon seller taxes might seem daunting, but fear not! This guide is here to break it all down for you. We’ll cover:

- What are Amazon seller taxes

- How to handle Amazon sales tax

- How to file taxes as an Amazon seller

- What can Amazon sellers do to save money

Let’s dive into it!

Scale Your Business Beyond Amazon with LitCommerce!

Already streamline your tax management and want to increase profits? Try our Amazon LitCommerce listing tool to enrich your multichannel business. The free plan is available.

What are Amazon Seller Taxes?

Amazon seller taxes are the tax Amazon gathers for sellers when their products sell on the platform. Usually, sales tax is what state and local governments charge on goods and services sold.

The exact amount of seller taxes on Amazon depends on where the buyer and seller are and what type of product is being sold.

Here are 3 main taxes Amazon sellers deal with:

- Income tax: Sellers must pay tax on their earnings from Amazon sales, which depends on their overall income and tax bracket.

- Sales tax: In the U.S., sales tax is a charge added to things we buy that aren’t seen as crucial. This tax changes depending on which state you’re in. Amazon handles sales tax for sellers in certain states. Yet, in some states, sellers must manage their own sales tax, so knowing state regulations is key.

- International taxes: Selling abroad might entail additional taxes like VAT or GST, contingent upon the destination country.

How to Handle Amazon Sales Tax?

As an Amazon seller, you’re responsible for collecting and paying sales tax for qualifying orders. How you manage Amazon seller taxes can vary based on factors like your business location and where you sell your items.

In this section, we’ll walk you through when and how to collect Amazon sales tax.

When must Amazon sellers collect sales tax?

When a seller signs up to sell on Amazon, they might need to gather sales tax themselves or let Amazon handle it. Amazon collects sales tax in states where it’s legally mandated, and then it sends that tax to the right state authority.

Here are 2 situations when you must collect seller taxes on Amazon:

1. Sales tax nexus

The sales tax nexus is like a link between a business and its state. It can be physical, economic, or both.

a. Physical nexus

If you have a physical presence in a state where you do business, you have a physical sales tax nexus there. This includes having an office, employee, warehouse, or stock in the state.

Sellers can have multiple physical nexuses. For example, if your office is in Los Angeles and your FBA inventory is in New York, you have nexus in both places.

Each state with Amazon seller taxes has different rules for licenses or permits. If you have a physical nexus in a state, make sure you’ve got all the necessary licenses or permits before you start selling.

b. Economic nexus

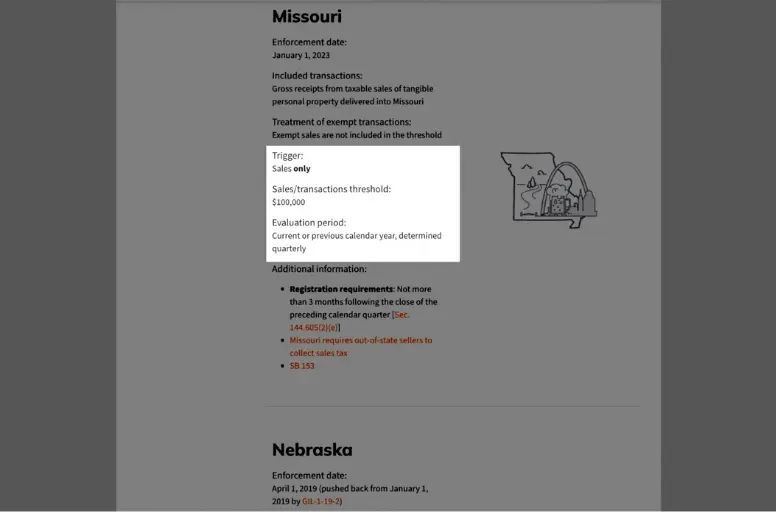

Economic nexus occurs when your sales reach a minimum value set by the state, often $100,000 in revenue and 200 transactions per year.

Economic nexus is more common for out-of-state Amazon sellers. However, new sellers need not worry much about it as they’re unlikely to reach such high sales initially. Still, it’s good to know about it.

Newcomers might find starting with FBA and handling taxes daunting. Before diving in, explore our detailed guide on How to Switch from Amazon Business to Personal? 2026 Tutorial

2. Product taxability

Product taxability decides if sales tax applies to a purchase. Some items aren’t taxed or have a lower tax rate depending on where they’re bought. States with no sales tax mean no tax is paid when buying there. In some states, essentials like food or clothes have lower tax rates.

Amazon handles tax collection for items sold on its platform. However, you can adjust tax rates for specific goods in certain states. It’s wise to review these settings, especially if your products may be taxed differently.

Certain situations exempt you from collecting seller taxes on Amazon, like when you’re a reseller selling to other businesses. As a reseller, you don’t need to collect sales tax because the final seller will handle it when they sell the item.

How to collect sales tax on Amazon?

As an Amazon seller, you are responsible for collecting and paying sales tax on orders shipped to states where you have a tax obligation.

Here’s how to set up online Amazon seller tax collection in your Amazon Seller account:

- Step 1. Decide your sales tax nexus: Figure out where your business has a sales tax connection. This includes your business location, where your products are stored, and where your customers are.

- Step 2. Register for a sales tax permit: Once you know your sales tax nexus, sign up for a sales tax permit in each state. This allows you to legally collect and pay sales tax on Amazon.

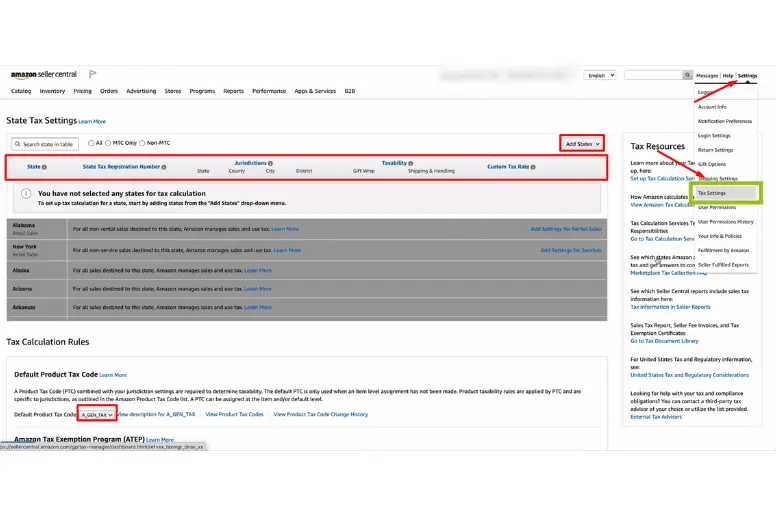

- Step 3. Set up sales tax collection on Amazon: Visit your Seller Central account and go to the Tax Settings page. Enter your sales tax permit details for each state where you have nexus.

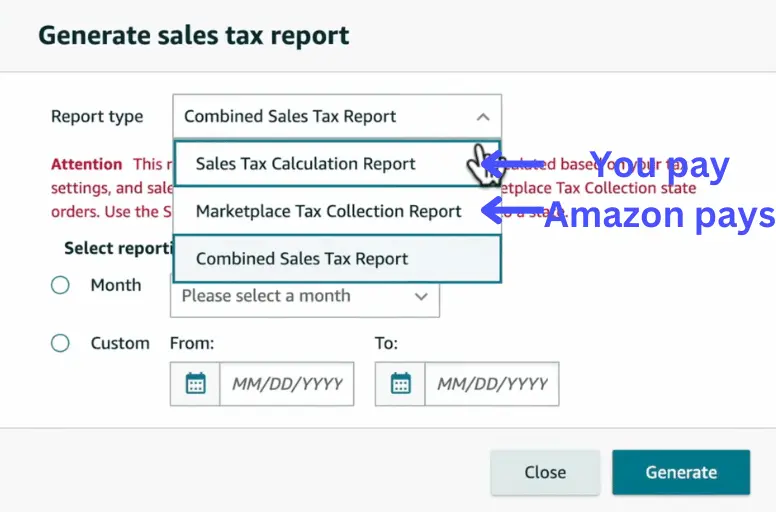

- Step 4. Collect sales tax on eligible orders: Amazon calculates and collects sales tax for eligible orders automatically, considering where the customer is and what products are bought. It’s vital to ensure you’re charging the right rate for each state. You can check it by visiting Amazon Seller Central > Reports > Tax Document Libary > click on Generate a tax report.

- Step 5. Remit Amazon seller tax: Regularly send the sales tax you’ve collected to each state. The frequency varies, so check the requirements for each state where you have nexus.

How to File Amazon Seller Taxes?

Even though Amazon manages sales tax for you, they don’t handle your business’s income tax. You’ll have to gather various small business tax forms, such as your 1099-K tax form and a 1040 Schedule-C, when you file your income taxes.

Here’s the detailed guide on how to file Amazon seller income tax by each form:

1099-K tax forms

The first question you may ask is, “What is Form 1099-K?”

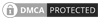

Form 1099-K is basically a tax form used to report income from third-party payment processors like Amazon. The Internal Revenue Service (IRS) requires Amazon to send it to sellers with over $20,000 in sales and 200 transactions per year.

In other words, 1099-K tax forms summarize all payments received from Amazon.

So, who must fill out the form 1099-K?

Amazon sellers who reach $20,000 in sales and 200 transactions will receive the 1099-K form. If you’re an individual or professional seller meeting these criteria, Amazon handles the Amazon seller taxes form for you and sends it to you and the IRS.

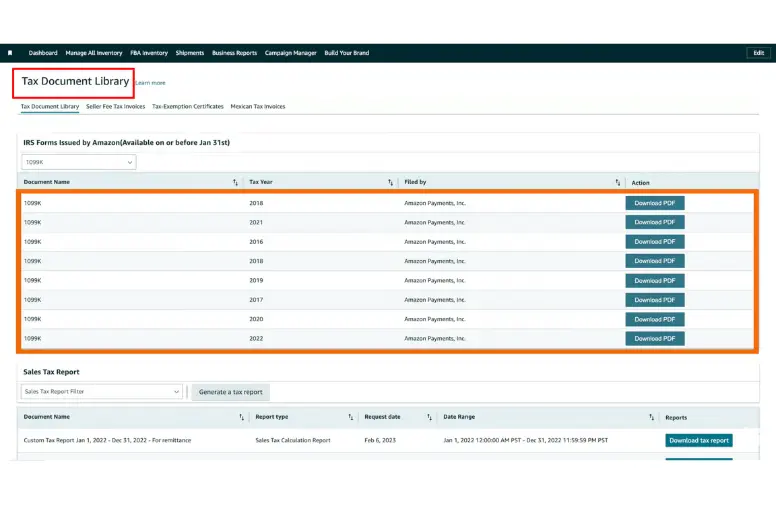

Now, you may wonder: where can I find my 1099-K form?

If you’re an active Amazon seller meeting the qualifications, you likely received it via email. But if not, here’s how you can find your 1099-K form in the tax central Amazon:

- Sign in to your Amazon Seller Central account

- Go to the Reports menu

- Choose Tax Document Library

- Then, download your 1099-K tax form

1040 Schedule-C

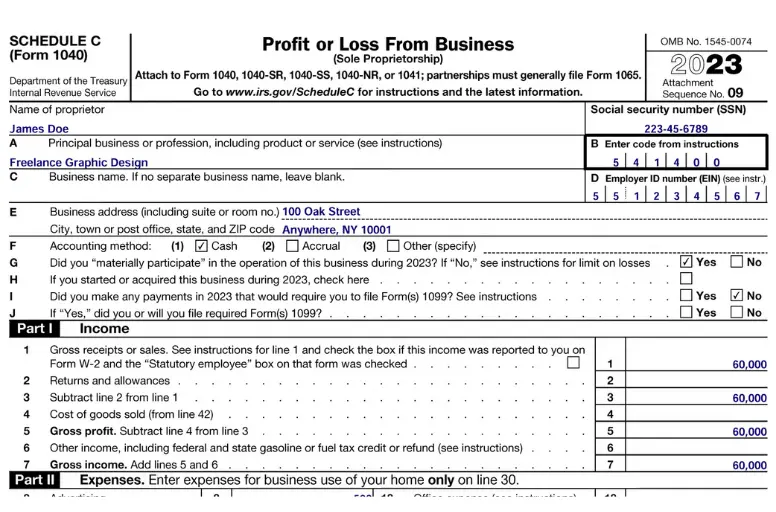

Another Amazon seller tax form you must file is Schedule C. So, what is a Schedule C tax form?

Schedule C, also called Form 1040, is a tax form for self-employed people to report business income and expenses. It’s used to calculate a sole proprietorship’s profit or loss.

Amazon sellers making a profit are seen as self-employed and pay self-employment taxes. So, if you’re an Amazon seller running a sole proprietorship, you must include Schedule C with your personal tax return to report your business costs and earnings.

Tax Deductions for Amazon Sellers

A deductible is an expense you can subtract from your income to reduce Amazon seller taxes. This reduction helps in lowering the taxes you are obligated to pay. Deductibles can also save you money on both business and personal taxes.

So, what can Amazon sellers deduct? Here’s a list:

- Cost of items sold, like manufacturing expenses, wholesale prices, etc.

- Shipping costs, including supplies and fees

- Expenses related to your office setup, such as office supplies, furniture, electronics, etc.

- Amazon seller fees

- Mileage expenses

- Donations, including damaged items, given to charity

- Subscriptions

- Education expenses relevant to eCommerce and online business

- Software purchases for inventory management and taxes

- Expenditure on online advertising, like print materials, business cards, ads, etc.

- Employee wages and benefits

- Consultant fees, such as those paid to a lawyer, accountant, etc.

Amazon Seller Tax – FAQs

The Amazon seller income tax you pay for your order depends on various factors: These factors might change from when you order to when it’s shipped, so your tax might change too. Amazon will handle collecting and paying the sales taxes for sellers with professional accounts. But they charge a 2.9% fee to cover their expenses. Once you meet the criteria, Amazon will email you the form. If you can’t locate the email, here’s how you can find your Amazon seller reports for taxes: Amazon provides sellers with a form known as 1099-K if they reach certain sales thresholds. This form details their earnings from selling items. Furthermore, they may need to submit additional tax documentation depending on their situation. For instance, if they run a business alone, they’d list their business earnings and costs on Schedule C (Form 1040). They’d then add this to their personal tax return (Form 1040). If they run a business with others or as a company, they’d need different tax forms.

It’s Time to File Your Amazon Seller Taxe

Filing Amazon seller taxes correctly is crucial for your success in the business. If you can maintain precise tax records, it’ll help you manage your finances better, track your business performance, and make informed decisions about growth.

So, what are you waiting for? Gather your tax forms, file them, and submit them promptly.

If you want to know more about Amazon and other selling tips, let’s head to our LitCommerce blog site. Contact us for assistance if you need an ultimate Amazon listing tool from LitCommerce.