Choosing the best place to sell supplements online is not as simple as picking the biggest marketplace. Each platform has different rules, fees, and levels of control, which directly affect how easy it is to sell and scale.

Selling supplements is also more complex than selling regular products. Marketplaces frequently update their health policies. Advertising approvals are harder to get. Costs continue to rise. If you rely on only one platform, a single policy change can disrupt your entire business. This guide keeps things simple. It compares the best platforms to sell supplements online and explains what really matters.

Sell Supplements Across Multiple Channels

With LitCommerce, you can manage and sell your supplements across multiple marketplaces and advertising channels from one place.

What Makes a Platform the Best Place to Sell Supplements Online

The global eCommerce nutritional supplements market was about USD 174.7 billion in 2024, with projections to reach roughly USD 276.3 billion by 2030 at an 8% CAGR. However, not all eCommerce platforms work well for supplements. Some allow easy setup but limit growth. Others bring traffic but come with strict rules. The best place to sell supplements online must balance opportunity and safety.

First, the platform must support supplement compliance. This includes clear rules for ingredients, labeling, and health claims. Platforms that reject listings often or change policies without warning create high risk.

Second, buyer trust matters. Customers want to feel safe buying supplements. Platforms with strong reviews, clear product pages, and secure checkout convert better.

Third, fees and profit margins matter. High commissions, ad costs, or fulfillment fees can quickly reduce profits. A good platform allows flexible pricing and healthy margins.

Finally, scalability is key. The best platform lets you grow, add new channels, and adapt to changes. Platforms that work well with ads, product feeds, and multichannel tools give supplement sellers a long-term advantage.

How We Evaluated the Best Places to Sell Supplements Online

This comparison is based on real-world selling conditions for supplement brands, not generic ecommerce theory.

Our evaluation framework focuses specifically on regulated products like dietary supplements, where compliance, approvals, and platform risk matter as much as traffic.

Platforms were ranked using the following factors:

- Buyer demand & traffic quality. How actively customers search for supplements on the platform.

- Supplement policy & compliance risk. Approval requirements, claim restrictions, and suspension risk.

- Selling fees & margin impact. Referral fees, payment fees, and hidden costs.

- Brand control & customer ownership. Ability to control listings, pricing, data, and repeat buyers.

- Scalability & long-term stability. How well the platform supports growth beyond a single channel.

Scores reflect practical suitability for supplement sellers, not just popularity.

Best Places to Sell Supplements Online (Platform Comparison)

Below is a practical comparison using real audience + fee benchmarks so you can see which platform is “best” depending on your goal (fast volume vs brand control vs lower fees).

Platform | Traffic Potential | Compliance Flexibility | Fees & Margins | Brand Control | Scalability | Overall Score |

Amazon | 7.5 / 10 | |||||

Shopify | 8.8 / 10 | |||||

TikTok Shop | 7.8 / 10 | |||||

eBay | 7.6 / 10 | |||||

Etsy | 7.2 / 10 |

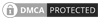

1. Amazon: Best for high-volume sales

Amazon ranks as the top platform for selling supplements primarily because of buyer intent, not branding. Unlike social or DTC platforms, Amazon customers actively search for supplements with the intention to purchase, not browse.

Within Amazon, Health & Personal Care is consistently one of the top-performing categories, with supplements accounting for a large share of repeat purchases. Many supplement-related keywords receive tens of thousands of monthly searches, creating built-in demand that new sellers cannot easily replicate on other platforms.

From a cost perspective, Amazon uses a category-based referral fee structure:

- 8% for items priced at $10 or below

- 15% for items priced above $10

These fees are calculated on the total sales price and can significantly impact margins, especially for low-priced supplements.

Where Amazon becomes challenging is compliance and control. Amazon has specific dietary supplement policies that go beyond general marketplace rules. When required, Amazon may request third-party testing, lab reports, or ingredient validation to verify product safety and claims. Sellers who cannot provide proper documentation risk listing removal or account suspension. In addition, Amazon tightly controls customer data and branding, limiting long-term brand ownership.

Amazon is best for: Sellers who prioritize fast sales volume and already have compliant products, reliable sourcing, and the ability to meet Amazon’s documentation and enforcement requirements.

Amazon is not ideal for: New supplement brands that rely on storytelling, subscriptions, or direct customer relationships, or sellers unprepared for potential third-party testing and validation requests.

Check our guide on 15 Best Wholesale Products to Sell: Maximize Your Profit.

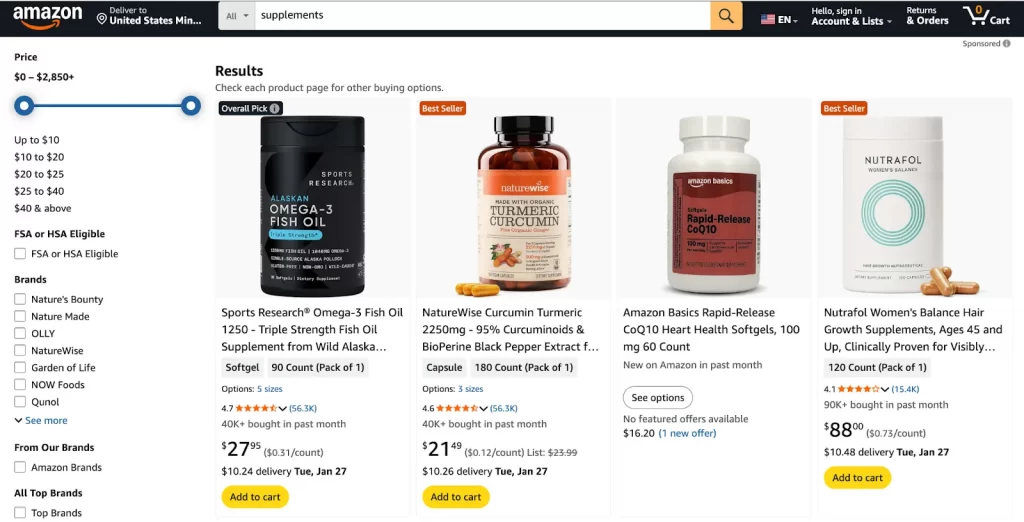

2. Shopify: Best for brand control and higher margins

It is no doubt that Shopify is one of the best selling platforms. Shopify stands out as the strongest platform for supplement brands focused on long-term growth and brand ownership. Unlike marketplaces, Shopify does not control your listings, customer data, or pricing. This makes it fundamentally different from Amazon, eBay, or Etsy.

The biggest advantage of Shopify is ownership. You control how your supplements are presented, how claims are framed (within legal limits), and how customers move through your funnel. More importantly, you own the customer relationship. This allows supplement brands to build email lists, subscriptions, bundles, and repeat purchase systems, which are critical in a category driven by long-term consumption.

From a cost perspective, Shopify is also more predictable. A common baseline is the Shopify Basic plan at $39 per month, plus ~2.9% + $0.30 per online card transaction when using Shopify Payments. Unlike marketplaces, there are no per-item referral fees, which means margins improve as order value increases. For supplement brands selling bundles or subscriptions, this pricing model is often more profitable over time.

The trade-off is traffic. Shopify does not bring buyers by default. Supplement sellers must generate demand through SEO, content, creators, paid ads, or Google Shopping. This requires more upfront effort and marketing skill, but it also removes dependency on a single marketplace algorithm or policy shift.

Shopify is best for: Supplement brands that want to build a real business asset, not just listings. It works especially well for repeat-purchase products, subscription models, private-label brands, and sellers who invest in traffic acquisition.

Shopify is not ideal for: Sellers who want instant demand without marketing, or those unwilling to manage ads, content, and customer retention systems.

Combine Brand Control with Marketplace Traffic

The smartest supplement sellers don’t choose between a store or a marketplace. They use both. Build your brand on your own store while tapping into high-intent traffic from marketplaces like Amazon, TikTok Shop, and Etsy

3. TikTok Shop: Best for fast discovery (especially if your product can go viral)

TikTok Shop is one of the fastest-growing channels for supplement discovery because it flips the traditional buying model. Instead of waiting for customers to search, TikTok creates demand through short-form content, creators, and affiliates.

On TikTok, supplements are sold through attention, not intent. A single video can introduce a product to hundreds of thousands of users in hours, especially when paired with creators who already have trust with their audience. This makes TikTok Shop especially powerful for supplements that are visually demonstrable, easy to explain, or closely tied to lifestyle trends.

From a cost perspective, TikTok Shop is relatively competitive. TikTok’s US guidance shows category-based referral fees, with most categories around 6%, and some as low as 5%. Compared to Amazon’s referral fees, this can leave more room for creator commissions and promotional pricing, particularly during early testing phases.

However, TikTok Shop has higher entry and policy risk for supplement sellers. Dietary supplements are not fully open-category on TikTok Shop. In many regions, this category is invite-only, meaning sellers must be approved or invited by TikTok before they can list and sell supplements. Even after approval, products may still be reviewed individually based on ingredients, claims, and content style.

Policy volatility is another challenge. TikTok frequently updates its supplement rules, and approvals can vary depending on ingredient lists, wording, or how a product is presented in videos. A supplement that performs well one month may face restrictions the next. In addition, success on TikTok requires consistent content production and creator collaboration, which not all brands are prepared to manage.

TikTok Shop is best for: Supplement brands with trend-friendly products, strong storytelling, and the ability to produce or collaborate on short-form video content consistently, especially for discovery-stage testing.

TikTok Shop is not ideal for: Brands that need immediate access to sell supplements, rely on stable and predictable demand, or cannot support ongoing content creation, affiliate management, and approval uncertainty.

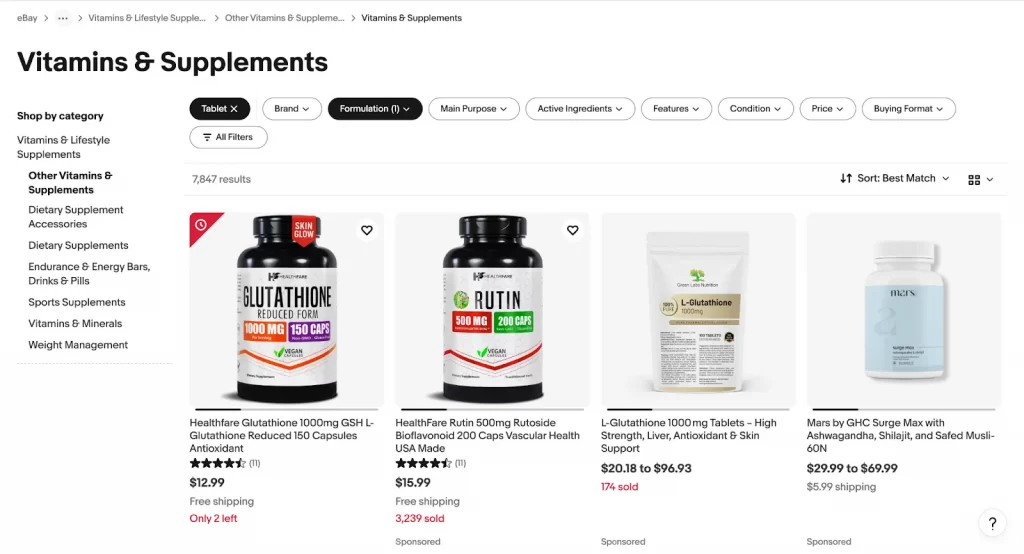

4. eBay: Best for wide reach and straightforward selling fees

eBay remains a strong option for supplement sellers who want access to global demand without Amazon-level complexity. With a long-established international buyer base, eBay allows sellers to reach customers across multiple countries from a single marketplace.

As of Q3 2025, eBay reported 134 million active buyers worldwide, making it one of the largest ecommerce platforms by audience size. This gives supplement sellers exposure beyond domestic markets, especially in regions where Amazon competition is high or marketplace rules are more restrictive.

From a cost standpoint, eBay’s fee structure is relatively transparent. For most categories, sellers pay a 13.6% final value fee plus $0.40 per order, calculated on the total sale amount. While this is comparable to Amazon’s referral fees, eBay typically offers more flexibility in listing formats and fewer brand-related restrictions.

Where eBay differs most is in how buyers purchase supplements. Many eBay customers look for value-based options such as bundles, multipacks, or repeat SKUs, rather than branded subscription experiences. This makes eBay effective for sellers moving volume across standardized products or targeting price-conscious international buyers.

The trade-off is brand perception. eBay does not offer the same brand-building tools as Shopify, nor the built-in trust signals of Amazon for supplements. Customer loyalty is harder to develop, and repeat purchases often depend on price rather than brand affinity.

eBay is best for: Supplement sellers focused on bundles, multipacks, and cross-border sales who want predictable fees and global reach without depending on Amazon’s ecosystem.

eBay is not ideal for: Brands that rely on subscriptions, storytelling, or long-term customer relationships.

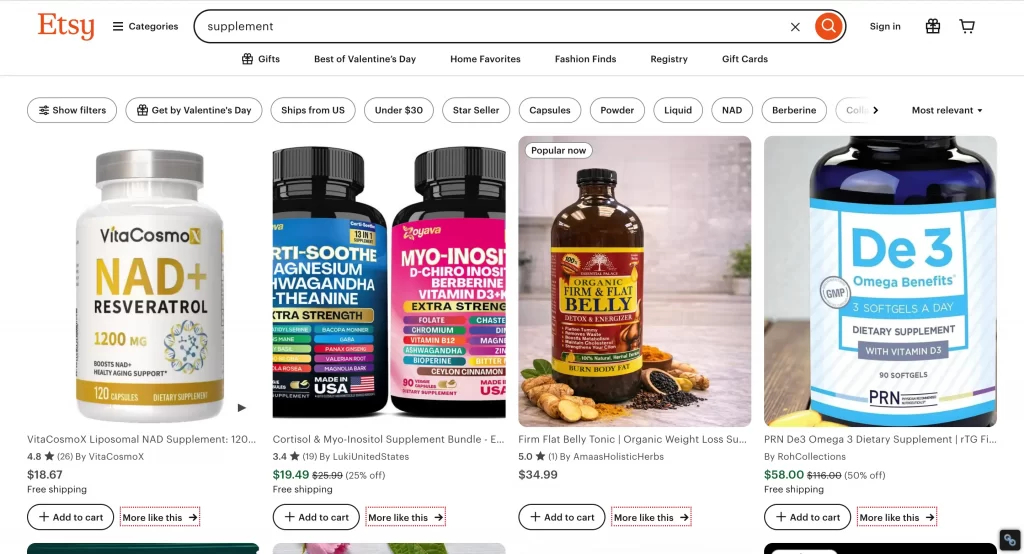

5. Etsy: Best for herbal/natural niche positioning

Etsy stands out as a marketplace built around trust, craftsmanship, and natural positioning, which makes it a strong fit for certain types of supplements. Unlike Amazon or eBay, Etsy buyers are not primarily driven by speed or price. They are looking for products that feel authentic, transparent, and aligned with wellness lifestyles.

As of Q3 2025, Etsy reported 86.6 million active buyers. More importantly, Etsy has seen growing visibility and listing activity around herbal, organic, and wellness-related products, including herbal blends, plant-based supplements, and traditional wellness formulas.

Unlike mass-market platforms, Etsy shoppers actively seek natural ingredients, transparent sourcing, and small-batch positioning. This demand pattern makes Etsy a stronger conversion environment for herbal and wellness-focused supplements, where trust, storytelling, and perceived authenticity matter more than scale or speed.

Etsy’s fee structure is also relatively accessible, especially for small or niche brands. In the US, sellers typically pay:

- $0.20 per listing or renewal

- 6.5% transaction fee on the total sale

- Etsy Payments fee of 3% + $0.25 per order

These costs are often lower than Amazon’s referral fees and make Etsy a reasonable testing ground for new herbal or wellness-focused products.

However, Etsy comes with strict limitations. Health claims are closely monitored, and products that resemble pharmaceutical supplements or make medical promises may be removed. Etsy is not designed for large-scale supplement brands, subscriptions, or aggressive advertising. Growth is slower and more dependent on storytelling, product descriptions, and niche trust.

Etsy is best for: Herbal and wellness-focused supplement brands that emphasize natural ingredients, transparency, and small-batch positioning. It works well when storytelling and customer trust matter more than scale.

Etsy is not ideal for: Mass-market supplements, performance-driven formulations, or sellers aiming for rapid, high-volume growth.

Best Place To Sell Supplements Online: Frequently Asked Questions

1. Do I need FDA approval to sell supplements online?

In the US, the FDA does not approve supplements before they are sold. The seller is responsible for product safety, accurate labeling, and compliance. The FDA can take action if a supplement is unsafe or misleading.

2. Which platform is the easiest to start selling supplements on?

Shopify is often the easiest platform to start with. It gives full control over your store and does not require marketplace approval. Marketplaces like Amazon or TikTok Shop may take longer due to category and product reviews.

3. Why do supplement listings get rejected or suspended?

Common reasons include unsupported health claims, missing ingredient details, inconsistent product data, and policy violations. Even small wording issues can cause problems, especially on ad platforms.

4. Why do supplement listings get rejected or suspended?

Common reasons include unsupported health claims, missing ingredient details, inconsistent product data, and policy violations. Even small wording issues can cause problems, especially on ad platforms.

5. Is it better to sell supplements on one platform or multiple platforms?

Selling on multiple platforms is safer. If one account is restricted or listings are removed, other channels can still generate sales. Multichannel selling also helps reach different types of buyers.

Best Place to Sell Supplements Online: Conclusion

There is no single best place to sell supplements online. Each platform serves a different purpose. Amazon drives fast volume, Shopify supports brand ownership, TikTok Shop accelerates discovery, eBay offers global reach, and Etsy works well for herbal and wellness niches.

Successful supplement sellers avoid relying on one channel. A multichannel approach reduces risk, adapts to platform changes, and creates more stable growth. To make this work, product data must stay accurate and compliant across every platform.

Multichannel selling tools like LitCommerce help simplify this process by centralizing product listings, syncing inventory, and managing product feeds across multiple sales channels from one place. With the right setup, selling supplements online becomes more predictable, scalable, and sustainable over time.