Etsy Sales Tax At A Glance

Does Etsy charge sales tax? YES, IT SURELY DOES!

Like any other top marketplace for selling products, Etsy has strict rules related to taxation and sellers’ liabilities within the matter. On this ground, we might say fulfilling every obligation regarding Etsy sales taxes is crucial. Apparently, it can help sellers avoid legal issues and partly build up their business sustainably.

Speaking of Etsy taxes, they are divided into three major categories, which are:

- Etsy income tax

- Selling tax per purchase

- Self-employment tax

Each of these will come in a detailed analysis later. Furthermore, Etsy seller tax calculation, collection, and remission depend on the seller’s location, applicable tax rate, overall sales revenue, and several other factors.

One more significant aspect that decides how much tax you must eventually pay to Etsy is your business model. According to the Etsy division, there are two models: Business and Hobby.

- As you start selling on Etsy, in any case, you regularly make profits off your hobby store. It is then a business.

- On the contrary, if you mainly run your store without expecting profits in return, you probably operate a hobby.

In each scenario, your obligations, considering Etsy sales taxes, will differ slightly. Accordingly, you must determine if you are running a business or a hobby. Such determination is made based on the 9 factors in the IRS rulebook (US Internal Revenue Service).

That’s the fundamental Etsy tax information you need to update. Now, as promised, we’ll walk you through 3 types of taxes on Etsy. Let’s delve into them!

How Do Taxes Work with Etsy? 3 Types of Etsy Taxes

Whatever dynamic selling platform you go live on, it is an unwritten rule that you stay updated about tax applications and your obligations. That being the cause, acknowledging well Etsy sales taxes and current rules is now your case as you run an Etsy shop.

Without further delays, let’s help you navigate the tax landscape clearly, so you can ensure compliance and make informed decisions to support the growth of your business! For Etsy sellers, understanding the components of a pay stub is also crucial when managing finances.

1. Etsy income tax

One basic sales tax on Etsy is the income tax. Briefly, when you sell items on Etsy, you must pay income tax to the federal government. In particular, your income from selling products after subtracting business expenses is taxable. The amount of Etsy income tax you pay is progressive and determined by your income level. Additionally, depending on your residence, you may be required to pay state income taxes.

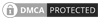

Etsy income tax and form 1099-K report

Generally, Etsy reports your overall earnings to the IRS using Form 1099-K. Meanwhile, even if you do not receive a 1099-K, you must still declare your income from Etsy sales when filing your tax return.

Regarding Etsy sales tax and your income, if you are a US seller who:

- Surpasses $20,000 in gross sales and conducts over 200 transactions in one year;

- Meets the state’s designated thresholds.

You will receive a 1099-K form, which you might refer to as an Etsy tax form. This form reports credit card payments handled by Etsy Payments to the IRS.

Essential considerations of Etsy 1099-K tax reports

- 1099-K reporting solely pertains to US sellers. If you reside outside the US, Etsy tax rules may differ. In this case, seek support from the house for location updates and any relevant information.

- Only sales processed through Etsy Payments factor into the IRS thresholds for receiving a 1099-K from Etsy. Sales made via alternative payment methods, such as PayPal, are not included in your Etsy 1099 sales total. However, separate 1099-K forms might be received from PayPal or other payment processors.

- The IRS thresholds apply to your gross sales volume received through Etsy Payments, encompassing shipping fees and the sales tax you have collected. Etsy Payments fees and refunds are not deducted from Etsy sales taxes. Nevertheless, you can deduct expenses such as shipping costs, sales tax, fees, and refunds as business expenditures during tax filing.

- If you have multiple Etsy shops using the same Employer Identification Number, your combined sales decide if you meet the 1099-K reporting thresholds. This applies to sellers who accept Etsy Payments. Ensure you maintain up-to-date taxpayer ID information for each shop to report your overall sales accurately. This also helps Etsy generate your exact tax amounts.

As an Etsy seller, you might also want to read:

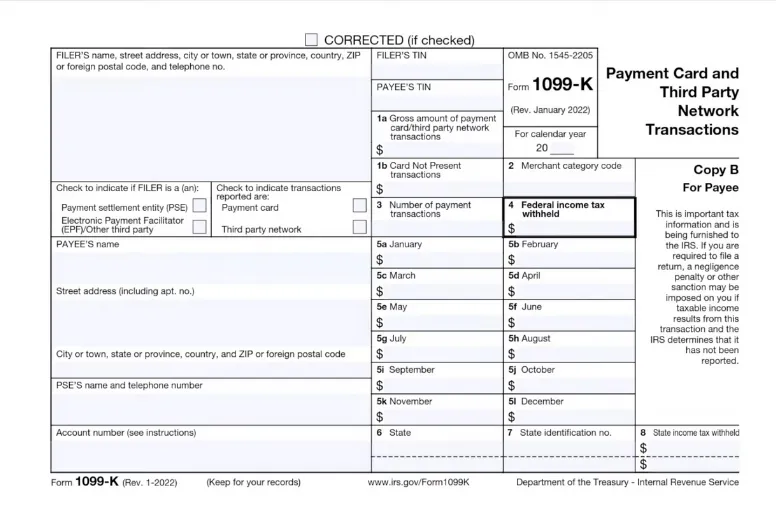

2. Selling taxes per purchase

The selling tax per purchase refers to the tax collected by sellers on behalf of their customers for every eligible transaction made on Etsy. When customers purchase items from sellers on Etsy, they may be required to pay sales tax on their purchases, depending on their location and the applicable tax laws.

Does Etsy collect sales tax? YES, IT DOES! As a matter of fact, Etsy facilitates the collection and remittance of sales taxes on behalf of sellers in certain states where it is legally required. The collected Etsy sales taxes are then remitted to the respective state or local jurisdiction.

However, Etsy shop taxes may sometimes not cover all tax obligations. If Etsy doesn’t handle sales tax for a situation, you can utilize the Etsy sales tax tool to set it up. You can also handle them yourself as well by:

- Researching the tax laws;

- Registering for a sales tax permit;

- Calculating the correct rate by using the Etsy sales tax calculator;

- Collecting tax from customers;

- And remitting the tax to the tax authorities.

In most cases, you don’t need to collect it if you don’t have a physical presence or meet the economic nexus threshold in a state where Etsy doesn’t facilitate sales tax.

Therefore, don’t forget to research and comprehend your state’s regulations to ensure compliance with sales tax obligations.

3. Self-employment taxes

Here comes another one in Etsy sales taxes. Notably, the self-employment tax refers to the tax that Etsy sellers must pay on their net business earnings. If your earnings, including sales on Etsy, reach or exceed $400, you have an obligation to pay self-employment tax. This Etsy tax covers both Social Security and Medicare contributions, similar to the taxes paid by individuals who are self-employed in other businesses or professions.

Currently, Etsy self-employment tax rates are as follows:

- 12.4% of the first $147,000 of your income for Social Security tax.

- 2.9% of your total income for Medicare tax.

However, if your income is classified as a hobby rather, you will need to pay Etsy income tax, not self-employment tax.

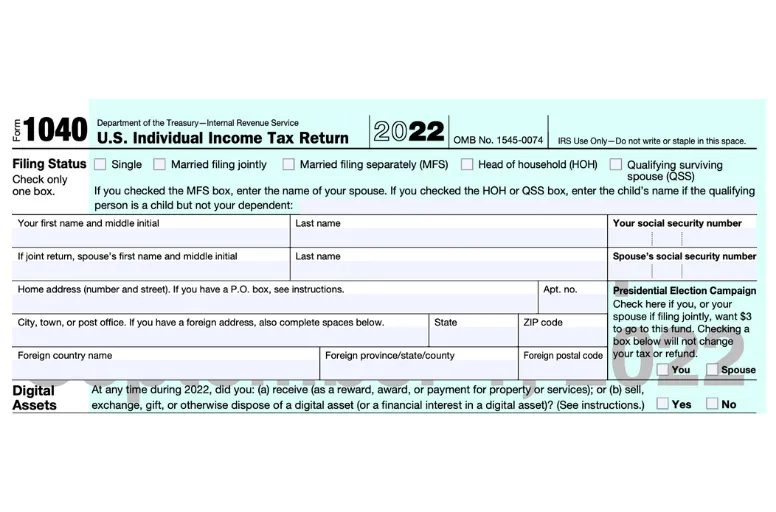

Does Etsy take out taxes on self-employment? The answer is NO, you need to do it yourself. To file your Etsy taxes, use Form 1040 or 1040-SR along with Schedule SE. Here’s how to file:

- Calculate your self-employment tax: Determine your net income from self-employment, including your earnings from Etsy sales. Calculate 92.35% of this amount, representing the portion subject to self-employment tax.

- Complete Schedule SE: Use Schedule SE (Self-Employment Tax) to calculate the actual amount of self-employment tax you owe. This form helps you determine the Social Security and Medicare taxes based on your net income.

- Report self-employment tax on Form 1040 or 1040-SR: Include the calculated self-employment tax on your federal tax return. If you file Form 1040, report it in the “Other Taxes” section. If you file Form 1040-SR, write it on the “Other Taxes” line.

- Make quarterly estimated tax payments: As a self-employed individual, you may need to make quarterly tax payments to cover your self-employment tax liability. Use Form 1040-ES to calculate and pay these Etsy sales taxes annually.

How to Report Etsy Income on Taxes?

Reporting your Etsy income on your tax return is critical in fulfilling your tax obligations as an Etsy seller. This section will guide you through the process of accurately reporting your income, ensuring compliance with tax regulations, and maximizing Etsy tax deductions.

1. Keep track of sales reports and documentation

To determine your final Etsy sales taxes precisely, you must keep track of your sales and any relevant documentation annually. Yet, to gain an overview of this action and its role in your Etsy tax reporting, keep scrolling through!

3 benefits of tracking sales reports and documentation

Maintaining accurate records is crucial for Etsy sellers regarding tax purposes. Doubtlessly, proper sales and documentation keeping can help to:

- Accurately report your income and expenses. That will prevent underreporting or overreporting of Etsy sales income, which can result in penalties or audits.

- Calculate your tax liability correctly. Detailed records of expenses allow you to claim specific Etsy tax exemption for business-related expenses, reducing taxable income and lowering tax liability.

- Provide supporting documentation for an audit case. Good record-keeping is crucial during tax audits. This is because it helps provide documentation to support reported information and defend tax positions.

5 strategies for precise sales tracking

To effectively organize and document your income and expenses before calculating final Etsy sales taxes, consider the following strategies:

- Separate business and personal finances: Open a separate bank account and credit card dedicated solely to your business. This separation helps you track business-related transactions and simplifies your record-keeping process.

- Keep detailed sales records: Maintain a comprehensive record of all your Etsy sales, including the date, item description, price, and customer information. Etsy provides sales reports that can effectively track your transactions.

- Track expenses: Maintain a system to track and categorize your business expenses. Use accounting software, spreadsheets, or a dedicated notebook to record your expenses. As well, capture relevant details like the date, vendor name, item description, amount, and expense purpose.

- Retain supporting documentation: Keep all supporting documentation, such as receipts, invoices, bank statements, and payment confirmations. Consider digitizing your records to ensure they are easily accessible and protected from damage or loss.

- Regularly reconcile your records: Reconcile your sales records with your bank deposits and expenses with your bank statements to ensure accuracy. This process helps identify discrepancies and ensures that all transactions are recorded properly.

2. Search for professional assistance

Engaging a tax professional or accountant can be a wise decision when handling Etsy sales taxes. Considering the matter, there are 3 reasons you should search for professional help, listed below.

- Professional consultants have expertise in tax laws and regulations to offer necessary instructions.

- They stay updated on changing tax laws, saving you resources, tracking the latest regulations, and dealing with Etsy tax reports.

- You can focus on other aspects of your business instead of concerning any issue related to taxes on Etsy.

While you can associate with hiring a tax professional, the potential benefits and cost savings they bring can outweigh the expenses. Expert tax advice helps you identify deductions and credits you may have overlooked. This can result in potential cost savings by reducing your liability on Etsy and taxes.

Moreover, a tax professional can handle complex tax calculations and paperwork, minimizing errors and maximizing efficiency. The peace of mind of knowing your taxes are handled by a professional is invaluable.

3. File and report

Etsy tax reporting includes several steps to ensure compliance with tax regulations. Here is a step-by-step guide on reporting Etsy income and paying applicable Etsy shop taxes:

- Determine your tax obligations: Understand the applying tax laws to your business based on your location (Etsy sales tax, income tax, etc.).

- Choose the appropriate Etsy tax form: Generally, Etsy income is reported on Schedule C (Form 1040), Profit or Loss from Business. Besides, Etsy has several other forms for different purposes, such as:

- Form 1040: The main individual income tax return form.

- Schedule SE (Form 1040): Calculates and reports self-employment tax.

- Form 1099-K: Reports income from credit card payments processed through Etsy Payments.

- Form 1099-MISC: Reports miscellaneous income from Etsy, including fees and refunds.

- Keep accurate records: Maintain detailed records of your Etsy sales and business expenses. This includes invoices, receipts, bank statements, and other documentation.

- Calculate your income: Calculate your Etsy income by subtracting any eligible business expenses from your total sales. This determines your taxable income and affects your overall Etsy sales taxes.

- Report your income: Include your Etsy income on your annual tax return. If you’re a sole proprietor, report it on your personal tax return using Schedule C or Schedule C-EZ (Form 1040). For other business structures, consult a tax professional for the appropriate tax forms.

- Pay estimated taxes: If Etsy doesn’t offer a sales tax calculator, sellers must estimate their tax rates throughout the year on their own. Regarding tax estimation, we suggest you evaluate your Etsy taxes and pay them quarterly to avoid underpayment penalties.

- Determine sales tax liability: If you need to collect and remit sales tax on Etsy, register for a sales tax permit. Also, follow the regulations of your jurisdiction for the Etsy sales tax report.

Remember that Etsy sales taxes vary depending on your location and circumstances. Thus, you should familiarize yourself with the specific regulations that apply to you.

How to Manage Your Etsy Sales Tax Effectively? 6 Best Practices

This should be the most thrilling part for all Etsy sellers out there – how to manage Etsy taxes effectively. From our observation and research, here are the best 6 tax practices for you.

- Understand your tax obligations: It is an unwritten rule that you acknowledge all your tax duties well, no matter what platform you are on. Based on platform requirements and business models, your tax liabilities may differ. Likewise, the case does not exclude Etsy seller tax.

- Register for sales tax permits: Depending on your location and applicable tax laws, your process to collect and remit sales tax can be complicated. Therefore, we highly recommend registration for tax permits.

- Configure Etsy tax settings: Go to your Etsy shop, check out Shop Manager, and navigate to Tax Settings. After that, familiarize yourself with all settings within the Tax section.

- Use all the support you can get: This can be a professional consultancy or an accounting app. As mentioned above, using help when dealing with Etsy sales taxes is extremely advisable. With the proper support, you might figure out specific Etsy tax exempt that gradually lower your overall selling expenses.

- Make use of Etsy sales tax calculator: Does Etsy handle sales tax for you? No, it doesn’t. However, the marketplace occasionally provides a sales tax calculator, which comes as a helpful tool. So, why not take advantage of it?

- File and remit taxes timely: We suggest you file and pay your taxes on time. This will prevent unwanted situations, which might refer to legal issues, a penalty, or a permanent ban.

A Complete Guide to Etsy Sales Taxes – FAQs

- 1. Do I need to pay income taxes on my Etsy earnings?

Yes, you are required to pay income taxes on your Etsy earnings. The income you earn from selling products on Etsy is taxable and must be reported to the tax authorities.

- 2. What records should I keep for tax purposes as an Etsy seller?

As an Etsy seller, keeping detailed records for future purposes is important. Some key records you should maintain include the following:

- Sales records

- Expense records

- Bank statements

- Receipts and invoices

- 3. Does Etsy collect sales tax for you?

Yes, according to marketplace facilitator laws, Etsy collects and remits taxes on behalf of sellers in many states. However, some states still require sellers to register and file returns themselves.

- 4. How do I determine the sales tax rates for different states or countries?

Etsy sales taxes can vary depending on the location of your customers. You can use online tools or consult the respective tax authorities to determine the sales tax rates for different states or countries. Many states provide sales tax rate lookup tools on their websites. Additionally, Etsy provides resources and guidance on sales tax collection for different jurisdictions.

- 5. How do I report my Etsy income on my tax return?

To report your Etsy income on your tax return, use Schedule C (Form 1040), the form for reporting business income and expenses. You will need to calculate your net income from your Etsy sales by subtracting your business expenses from your total sales. This net income is then reported on your tax return (Form 1040). Additionally, if you receive a Form 1099-K from Etsy, you must inform the income listed on the form on your tax return.

We recommend consulting with a tax professional or using tax software to ensure accurate reporting of your Etsy income.

- 6. Does Etsy report to IRS?

Yes, it does. Etsy reports certain financial information to the IRS annually, which includes tax-related details. The reported information is retreated from the 1099-K tax form that Etsy provides its sellers.

- 7. Do I need a sales tax permit to sell on Etsy?

Yes, you need a sales tax permit to sell on Etsy. This will serve you in your process to collect and remit Etsy sales taxes legally. The case applies to other selling platforms as well.

- 8. What states does Etsy not collect sales tax?

In the US, Etsy doesn’t collect sales tax in Delaware, Alaska, New Hampshire, Montana, and Oregon.

- 9. How much do I have to make on Etsy to file taxes?

If you make $400 or above from Etsy, you will then have to file taxes. Nonetheless, remember that this applies to your net income, not overall sales revenue. In any case, your net income doesn’t reach $400, you won’t be subject to paying Etsy sales taxes.

Mastering Your Etsy Tax – Wrapping Up

Taxes can immensely affect your total costs to start an Etsy shop. Therefore, understanding and properly managing your Etsy sales taxes as a seller is crucial. Regarding this aspect, we advise you to keep accurate records, consider seeking professional assistance, and stay informed about tax laws. By doing so, you can effectively report your Etsy income and meet your tax responsibilities while minimizing any potential issues or penalties.

Apart from the topic of taxes and Etsy, you can explore more about eCommerce by visiting our Retailer blog or becoming a member of our elite community. More than that, LitCommerce and our support team can help to enhance your understanding and success in the online marketplace. If you are interested in reaching new knowledge heights, we’ll be honored to give you a helping hand!