Walmart isn’t just the world’s largest retailer—it’s also a global supply chain powerhouse. Behind its “Everyday Low Prices” promise lies one of the most sophisticated logistics systems ever built. From cutting-edge technology to strategic vendor partnerships, Walmart supply chain is a masterclass in efficiency, scale, and innovation.

In this 2026 update, we’ll take you inside Walmart supply chain strategy to explore the core pillars that drive its success. You’ll learn how advanced automation, omnichannel logistics, and sustainability initiatives help Walmart stay ahead—and what your business can learn from their playbook.

Why Walmart Supply Chain Is a Global Benchmark

The Walmart supply chain is considered a gold standard in global logistics. Its unmatched scale, integration of advanced technologies, lean management practices, and strategic supplier partnerships allow Walmart to operate with high efficiency and resilience. Here’s what makes it a global benchmark:

1. Global sourcing and direct supplier relationships

Walmart sources products directly from a vast global network of manufacturers, cutting out traditional intermediaries to reduce costs and streamline procurement. This direct-to-supplier model gives Walmart more control over pricing, quality, and inventory flow—ensuring product availability across its stores and eCommerce platforms at scale.

2. Advanced distribution network and cross-docking efficiency

A core strength of the Walmart supply chain lies in its network of Regional Distribution Centers (RDCs), which leverage cross-docking systems. Goods move directly from inbound to outbound trucks with minimal storage time, accelerating inventory turnover, reducing warehousing costs, and keeping store shelves stocked with remarkable speed and precision.

3. Technology-driven supply chain operations

Walmart has long been a leader in adopting next-gen technologies to optimize its logistics. With AI, machine learning, and predictive analytics at the core, Walmart improves demand forecasting, route planning, and inventory visibility. Real-time data sharing with suppliers enables responsive, data-informed decisions across every touchpoint of the supply chain.

4. Lean inventory and supplier-managed stock

By applying lean manufacturing principles—like Just-in-Time (JIT), Kaizen, and continuous flow—Walmart minimizes waste and keeps inventory levels optimal. Its Supplier Managed Inventory (VMI) program empowers vendors to manage their own stock within Walmart’s ecosystem, resulting in quicker replenishment, reduced storage needs, and better product availability.

5. Seamless omnichannel fulfillment and last-mile innovation

The Walmart supply chain supports a highly integrated omnichannel system, connecting brick-and-mortar stores, online orders, and last-mile delivery. With innovations like curbside pickup, same-day delivery, and machine-learning-powered delivery routing, Walmart ensures fast, convenient service that meets the expectations of today’s digital consumers.

6. Sustainability and supply chain transparency

Walmart is actively working to make its supply chain more sustainable. Initiatives include energy-efficient transportation, waste reduction programs, and the use of blockchain to improve food traceability. These efforts not only enhance transparency and safety but also position Walmart as a leader in responsible retail logistics.

7. Strong vendor collaboration and strategic partnerships

Long-term, high-volume supplier relationships are fundamental to Walmart’s operational success. Through collaborative planning, forecasting, and replenishment (CPFR), Walmart and its vendors align goals, improve service levels, and reduce the risk of supply chain disruptions.

The Technology Powering Walmart’s Supply Chain

The Walmart supply chain is more than a physical network of suppliers and warehouses—it’s a digital powerhouse driven by cutting-edge technology. From artificial intelligence to real-time data sharing, Walmart’s investment in tech has revolutionized its operations and set new standards for retail logistics.

1. Real-time inventory tracking with RFID and Smart Tags

Walmart was one of the first major retailers to implement RFID (Radio-Frequency Identification) across its supply chain. By tagging products and pallets, Walmart can track inventory location and movement in real time. This drastically reduces stockouts, improves shelf accuracy, and enhances loss prevention, especially in high-volume stores. This focus on speed and accuracy plays a crucial role in optimizing Walmart supply chain fulfillment across all channels.

2. Centralized databases and in-house software platforms

At the heart of the Walmart supply chain is a centralized IT infrastructure that connects stores, distribution centers, and suppliers. Walmart’s proprietary systems—developed in-house—allow seamless communication and synchronization across the supply chain, enabling faster decision-making and stronger operational alignment. This integrated network is a cornerstone of the broader Walmart supply chain strategy, allowing the company to scale globally while maintaining operational efficiency.

3. AI and predictive analytics for demand forecasting

Walmart uses artificial intelligence and machine learning algorithms to predict consumer demand, adjust replenishment schedules, and optimize stock levels across locations. These technologies help the company anticipate trends, reduce overstock or understock scenarios, and respond quickly to seasonal or unexpected changes in demand.

4. Route optimization and transportation tech

Advanced routing software and GPS technologies help Walmart reduce transportation costs and environmental impact. Real-time delivery tracking and smart route planning improve driver efficiency and ensure faster delivery windows. Walmart also explores autonomous vehicle technology to further enhance last-mile logistics in the near future.

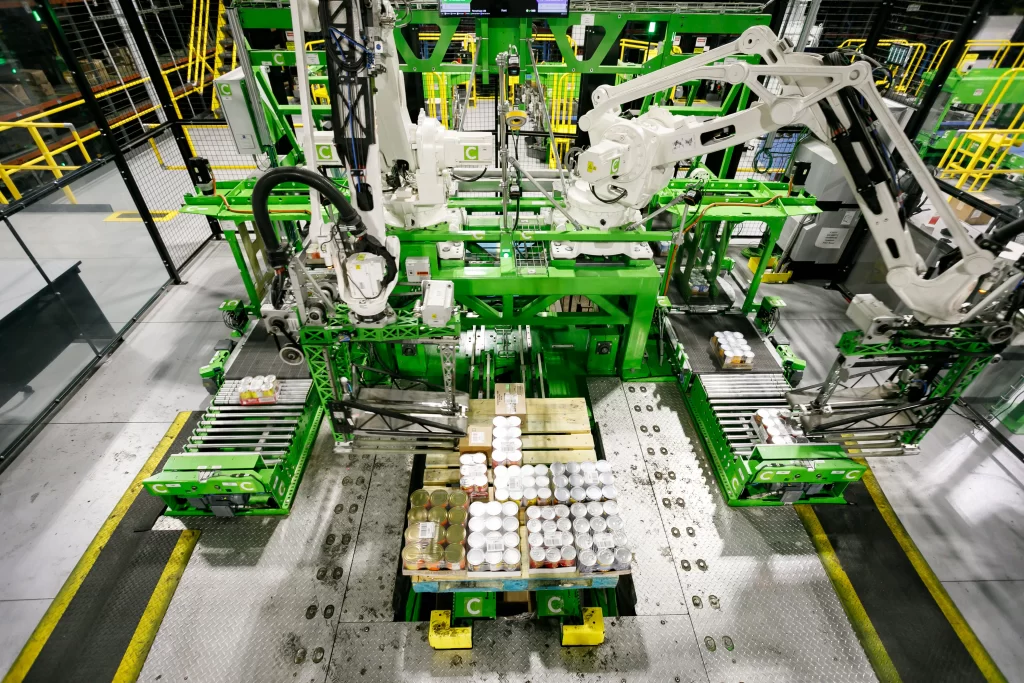

5. Automation in warehousing and fulfillment centers

Walmart continues to expand the use of automated picking systems, robotic pallet movers, and drone-assisted inventory checks in its fulfillment centers. These technologies speed up order processing, reduce labor costs, and improve accuracy—ensuring high-volume order fulfillment with minimal errors. This level of automation is one of the defining characteristics of the supply chain of Walmart, helping it stay ahead in both efficiency and scalability.

6. Integrated data sharing with suppliers

Through systems like Retail Link, Walmart enables suppliers to access real-time sales data, performance dashboards, and inventory levels. This transparency helps suppliers plan more accurately, forecast demand, and respond proactively—strengthening the end-to-end efficiency of the Walmart supply chain.

Key Pillars of Walmart Supply Chain Ecosystem

Walmart didn’t become a global retail powerhouse by accident. It built its empire on smart decisions, strategic partnerships, and a relentless focus on efficiency.

And it all starts with sourcing.

Rather than relying on middlemen, Walmart goes straight to the source. Over 100 countries, thousands of suppliers, and one clear mission: keep costs low and shelves full. The result? Private-label brands like Great Value that look and feel like national names—just without the markup.

Then there’s the magic of logistics.

Walmart doesn’t just move products from point A to point B. It does it with precision. Cross-docking is the secret sauce. Goods arrive at a distribution center, stay just long enough to switch trucks, and head straight back out. No sitting around. No wasted time. It’s a system built for speed—and savings.

But even that wasn’t enough.

So Walmart took things a step further. It handed the inventory keys over to the suppliers.

Literally.

Through vendor managed inventory (VMI), suppliers gained access to Walmart’s real-time stock data. They could track when their products were running low and ship more—no need for Walmart to lift a finger. It was a win-win. Walmart got fully stocked shelves. Vendors got consistent, predictable orders. Everyone made money.

Behind the scenes, regional distribution centers keep the whole operation running smoothly. More than 150 of them. Each one strategically placed, feeding dozens of nearby stores. Think of them as the beating heart of Walmart’s logistics network—pumping out products across the country day and night.

And while all this sounds complex (and it is), it works because every part is connected. Sourcing. Warehousing. Inventory. Vendors. Distribution. Each piece fits like a gear in a well-oiled machine.

The result? Walmart doesn’t just restock shelves. It moves with a rhythm few retailers can match.

Omnichannel Logistics: How Walmart Delivers Seamlessly

As retail moves rapidly toward hybrid experiences, the Walmart supply chain has adopted an omnichannel strategy that blends online convenience with in-store reliability. Here’s how Walmart creates a seamless customer journey while optimizing logistics.

1. Real-time inventory visibility = Accurate stock, everywhere

Customers can view up-to-date stock levels whether shopping online, through the app, or in-store. Walmart achieves this by syncing inventory systems across all channels, enabling faster fulfillment and reducing missed sales.

2. BOPIS and curbside pickup = Convenience at scale

Walmart’s Buy Online, Pick Up In Store and curbside options are powered by store-level fulfillment algorithms and in-app order tracking. These services meet consumer demand for speed without additional warehouse investment.

3. Ship-from-store = Faster local delivery

By turning stores into micro-fulfillment hubs, Walmart shortens delivery distances and improves last-mile efficiency. Smart routing tools assign orders to the nearest stocked location, lowering shipping costs and carbon output.

4. Marketplace + Fulfillment integration = More choices, same experience

Third-party sellers on Walmart Marketplace use Walmart Fulfillment Services or approved partners to ensure quick, reliable shipping. This keeps customer satisfaction high while scaling Walmart’s online catalog.

5. Flexible delivery = Loyalty and repeat purchases

Programs like Walmart+ provide free, fast delivery on thousands of items, increasing customer loyalty. These capabilities are backed by the same predictive analytics and real-time data systems that power the broader supply chain.

Sustainability in Walmart Supply Chain

Walmart moves fast. But it’s also working hard to move greener.

For a company that operates over 10,500 stores in 19 countries, sustainability isn’t just a buzzword—it’s a logistical challenge on a global scale. And Walmart is tackling it head-on.

Back in 2005, Walmart set an ambitious goal: to become supplied 100% by renewable energy, create zero waste, and sell sustainable products. Fast forward to today, and it’s made serious strides.

Walmart’s Project Gigaton is leading the charge. Launched in 2017, this initiative aims to cut 1 billion metric tons of greenhouse gases from its global supply chain by 2030. As of 2024, suppliers have already reported over 750 million metric tons reduced—that’s the equivalent of taking more than 160 million cars off the road for a year.

And it’s not just carbon.

Walmart’s supply chain is becoming smarter about packaging too. Through material redesign and waste reduction strategies, the company has eliminated over 2.1 million metric tons of plastic packaging across its global operations since 2015.

Transportation is another target. Walmart is actively transitioning to zero-emission delivery fleets, including electric last-mile vans and hydrogen-powered long-haul trucks. The company has committed to achieving zero emissions across all operations by 2040—no offsets, no excuses.

Even suppliers are held to new environmental standards. Walmart’s Sustainability Index and Sustainability Hub now track and guide vendor progress on everything from water conservation to ethical sourcing.

In short? Walmart’s not just optimizing for cost anymore—it’s optimizing for the planet.

Walmart Supply Chain: Technology and Automation in Action

Walmart isn’t just a retail giant—it’s a tech powerhouse in disguise.

And it had to be. When you’re moving over 600 million packages a year through more than 4,700 stores across the U.S. alone, human hands just won’t cut it. Walmart figured that out early and invested heavily in tech.

It started with barcodes. Then came RFID tags—those tiny, powerful trackers that now help Walmart monitor over 94% of its U.S. store inventory in real time.

That alone was a game changer.

But Walmart didn’t stop there.

It rolled out AI-powered demand forecasting tools across its supply chain, helping reduce forecast errors by up to 30%. The system learns, adapts, and even predicts when items will go out of stock—before it happens.

And inside its massive distribution centers? It’s a symphony of automation.

Robotic palletizers, automated guided vehicles, and conveyor systems work in harmony, processing millions of units per week. In fact, Walmart’s distribution centers are so efficient that a truckload of inventory can be processed and dispatched in less than 24 hours.

Everything’s connected—from supplier to shelf to your doorstep. Every scan, every shipment, every restock—it’s tracked and optimized.

This isn’t just automation. It’s intelligent logistics at enterprise scale.

And it’s exactly why Walmart doesn’t just compete—it leads.

Walmart Supply Chain: Streamlined Inventory Management

Inventory is where most retailers stumble.

Not Walmart.

With $56 billion in inventory value reported in its 2024 fiscal year, Walmart’s ability to manage stock efficiently is nothing short of extraordinary.

It starts with segmentation. Walmart doesn’t just keep a “stockroom”—it categorizes inventory by purpose: finished goods ready for shelves, transit inventory en route to stores, buffer inventory to cushion demand surges, and anticipation inventory for events like Black Friday or back-to-school season.

This isn’t just organized—it’s surgical.

Thanks to its advanced forecasting and real-time tracking systems, Walmart’s average inventory turnover ratio sits at 8.5x, meaning it sells and replaces its entire inventory more than eight times per year. That’s fast—even by retail standards.

And remember the vendor-managed inventory (VMI) system? Walmart was one of the first to adopt it. Today, thousands of suppliers actively monitor and replenish their own products on Walmart shelves. Through data sharing and predictive alerts, vendors know when stock is running low and send replacements—often before stores even notice.

Walmart also supports up to 10 inventory locations per product SKU, ensuring that items are strategically stored across the country for maximum speed and minimal waste.

In short, Walmart doesn’t just stock shelves.

It orchestrates inventory like a conductor with a finely tuned symphony.

You may also like: Walmart Private Label Brands: The 2026 List.

Walmart Supply Chain: Workforce Strategy

Managing a supply chain this massive takes people. Lots of them.

Walmart employs over 2.1 million associates worldwide, making it the third-largest employer on the planet, right behind the U.S. Department of Defense and China’s People’s Liberation Army. And while the scale is jaw-dropping, what’s even more impressive is how Walmart keeps the machine running smoothly.

It starts with labor optimization.

Walmart has invested millions into scheduling algorithms and labor forecasting tools. These systems match staffing levels with store traffic patterns, delivery schedules, and inventory needs—down to the hour. So if foot traffic spikes at 5 p.m. on Fridays? More hands on deck.

And training isn’t an afterthought.

In 2023, Walmart opened its 250th Walmart Academy, where associates learn everything from inventory flow to advanced data analytics. These aren’t just crash courses—they’re career pathways. Over 75% of Walmart’s store management started as hourly associates. It’s a workforce strategy built on internal growth, not just external hires.

But Walmart also knows that tech + humans = magic.

That’s why it introduced tools like the Me@Walmart app, giving hourly employees real-time updates on scheduling, inventory alerts, and task assignments. It’s part of a broader shift to make the frontline smarter, faster, and more autonomous.

Bottom line: Walmart treats its workforce like an integral piece of its supply chain infrastructure—not a separate cost center. And with over 240 million customers served weekly, that investment pays off.

Check our guide on how to win Walmart Buy Box.

Lessons from Walmart: What Businesses Can Learn

The Walmart supply chain isn’t just a marvel of scale—it’s also a blueprint for operational excellence. Here’s how you can apply their best practices to your own business, regardless of size or industry.

1. Defining clear inventory types to improve accuracy and planning

Walmart segments its inventory into key categories: finished goods, buffer stock, anticipation inventory, and transit inventory. This granular structure allows them to manage stock levels more precisely across various stages of the supply chain.

By knowing exactly what type of inventory is where and why, Walmart can avoid both overstock and stockouts. Businesses that follow this approach gain tighter control over product flow, improve forecasting accuracy, and reduce unnecessary storage costs—a practice central to effective Walmart supply chain management.

2. Using real-time data to make smarter, faster decisions

One of the defining features of the Walmart supply chain strategy is its reliance on real-time data to make informed decisions. From forecasting demand spikes to adjusting inventory replenishment, Walmart’s centralized systems give their teams clear, immediate visibility into every supply chain touchpoint.

Smaller businesses can replicate this by implementing cloud-based inventory tools or POS platforms that track stock, alert for low inventory, and even suggest reorder points based on sales trends.

3. Building long-term supplier relationships for cost and consistency

Walmart’s supply chain thrives on deep-rooted partnerships with suppliers. Instead of switching vendors frequently, they focus on high-volume, long-term contracts that ensure price stability and reliable product availability.

By committing to vendor-managed inventory models (VMI) and collaborating on shared goals through CPFR (Collaborative Planning, Forecasting, and Replenishment), Walmart prevents miscommunication and streamlines the flow of goods. This level of supplier trust supports a more predictable and scalable Walmart supply chain process.

4. Connecting all sales channels for unified fulfillment

Walmart’s ability to serve both in-store and online customers relies on a unified system that syncs inventory across all locations. Orders can be fulfilled from warehouses, physical stores, or third-party sellers—all depending on speed and proximity.

Adopting an omnichannel mindset early helps smaller retailers increase their flexibility and reduce shipping delays. Local fulfillment, store pickups, and consistent pricing across platforms can elevate customer satisfaction and build brand loyalty—especially when modeled after Walmart’s broader distribution strategy that prioritizes speed and store-level accessibility.

5. Automating key logistics tasks to save time and reduce errors

While Walmart leads in advanced warehouse automation, their approach to process efficiency is scalable. Even simple tools—like auto-generated purchase orders, barcode scanning, or integrated shipping labels—can free up hours of manual work and reduce costly errors.

Automation doesn’t have to be expensive. The key is identifying repetitive tasks that can be systematized and gradually scaling up from there.

6. Embedding sustainability into the core of logistics operations

The Walmart supply chain fulfillment model proves that efficiency and environmental responsibility can coexist. From using electric trucks to implementing reusable packaging and cutting carbon emissions, Walmart’s green initiatives also support their bottom line.

Businesses can start small: choosing recycled materials, working with local suppliers to reduce transport emissions, or even educating customers on eco-conscious shipping options. These changes can lead to cost savings and a stronger brand reputation over time.

Walmart Supply Chain FAQs

1. Does Walmart manage its own supply chain?

Yes, Walmart directly manages a large portion of its supply chain, from procurement and warehousing to fulfillment and last-mile delivery. It also works closely with suppliers through systems like Vendor Managed Inventory (VMI) and Retail Link to streamline collaboration. This hybrid of centralized control and strategic partnerships gives the Walmart supply chain its efficiency and scalability.

2. What is Walmart supply chain strategy?

The Walmart supply chain strategy focuses on four pillars: direct sourcing, regional distribution, technology integration, and long-term supplier relationships. Walmart emphasizes real-time inventory tracking, automation, and cost-efficiency to support its promise of low prices and high product availability across all channels.

3. How does Walmart use technology in its supply chain?

Walmart leverages RFID, machine learning, AI forecasting, and IoT sensors to manage inventory, predict demand, and automate logistics processes. These technologies are central to maintaining visibility and speed throughout the Walmart supply chain process, from warehouse to customer doorstep.

4. What is Walmart’s distribution model?

Walmart uses a hub-and-spoke distribution model centered around Regional Distribution Centers (RDCs). Through a method called cross-docking, products are moved directly from inbound trucks to outbound delivery with minimal storage time. This Walmart distribution strategy reduces costs and increases efficiency by minimizing delays and unnecessary warehousing.

5. How does Walmart fulfill online orders?

Walmart fulfills online orders using a combination of central fulfillment centers, ship-from-store capabilities, and third-party partners via Walmart Fulfillment Services (WFS). Its omnichannel fulfillment model integrates store and online inventory to offer fast, flexible delivery and pickup options.

Final Thoughts on the Walmart Supply Chain

The Walmart supply chain stands as a global benchmark for efficiency, innovation, and adaptability. From streamlined vendor relationships to advanced automation and omnichannel logistics, Walmart has built a logistics ecosystem that continues to evolve with consumer expectations and retail technology.

For eCommerce sellers and retailers looking to apply these lessons, tools like LitCommerce can help bridge the gap. Whether you’re managing inventory across multiple platforms or aiming to unify your sales channels like Walmart does, LitCommerce empowers you with simple, scalable solutions.

Want more insights like this? Explore the LitCommerce Blog for expert strategies on multichannel selling, supply chain trends, and marketplace growth.

Have questions or need help building your own multichannel strategy? Contact us here—we’d love to support your business journey.