No, having an LLC (Limited Liability Company) isn’t mandatory for selling on Amazon. You can begin as a sole proprietor with your Social Security number. However, having an LLC may benefit your store in certain ways.

An LLC generates a separate legal entity from you. This means your personal assets (like your car or house) are generally protected from business liabilities (like lawsuits). It can also offer tax advantages and make your business appear more professional. To help you get your own answer to the question “Do I need an LLC to sell on Amazon?”, this article will explore some aspects such as:

- What is LLC for Amazon sellers?

- How does an LLC differentiate from a sole proprietorship?

- Why should you have LLC for Amazon?

- How to start an LLC for Amazon store?

- What are the 5 best Amazon LLC filing services?

Let’s dig into each of the sections now!

What is LLC for Amazon Sellers?

LLC stands for Limited Liability Company. Owning an LLC shields your personal belongings from business troubles. The LLC acts as a separate entity, so if someone sues the business or it owes money, your own things are typically safe. This means that if an Amazon seller faces legal issues or debts, their personal assets are generally not at risk.

Starting an LLC is a breeze for Amazon sellers. It’s much simpler and involves less paperwork than other business options like corporations. The formation process can typically be completed online or through an online business formation company. It is overseen by the state government.

How is an LLC Different from a Sole Proprietorship?

When it comes to starting a business on Amazon, one of the first decisions you’ll need to make is what type of legal structure you want to operate under. Two common options are an LLC and a sole proprietorship. We have defined LLC for Amazon above. So, what is sole proprietorship?

In a sole proprietorship structure, there is only one person running and operating an LLC business. This is the simplest and most common form of business ownership.

There are several key differences between an LLC for Amazon and a sole proprietorship. Here’s the breakdown:

#1 – Liability

This is the key difference. A sole proprietorship offers no liability protection. You and your business are considered one entity. If your business gets sued or owes money, your personal assets (like your car or house) are on the line to cover it.

Meanwhile, LLC for Amazon sellers provides limited liability. This means your personal assets are generally shielded from business debts and lawsuits. The LLC itself is responsible, not you directly. This offers significant protection.

#2 – Formation

Sole proprietorships are the easiest to set up. There is usually no formal registration required; you just need to obtain the necessary business licenses. Here are some common examples of necessary business licenses if you do business on Amazon: zoning permits, sales tax permits/licenses, health department permits

LLCs involve filing articles of organization with your state. There are also annual fees to maintain the LLC status. They typically range anywhere from $50 to a few hundred dollars, depending on your specific state. Some states require them annually, while others require them biennially (every two years).

#3 – Taxes

Both are considered pass-through entities. The business profit or loss “passes through” to the owner’s personal tax return. You pay taxes on your business income on your individual tax return.

However, LLC for Amazon has more tax flexibility. LLCs have the flexibility to switch to corporate tax status (S corp or C corp) if it makes more sense for your tax situation. Let’s break down the key differences between S corporations and C corporations:

- S Corp: S corporations follow a pass-through taxation system similar to LLCs. The corporation itself doesn’t pay income tax. Instead, the profits and losses “pass through” to the shareholders’ personal tax returns, where they are taxed at individual income tax rates. This avoids double taxation, which is a major advantage.

- C Corp: C corporations follow a double taxation system. The corporation pays income tax on its profits at the corporate tax rate. Then, when the corporation distributes those profits to shareholders as dividends, those dividends are taxed again as personal income for the shareholders.

#4 – Management

A sole proprietorship is by definition a one-person operation. You make all the decisions.

LLCs can have one owner (a single-member LLC) or multiple members. The management structure is more flexible, and operating agreements can outline how the LLC is run and how profits are shared. More specifically, the management capabilities of LLC for Amazon will be talked about in the next section

In short:

- Sole proprietorships are easy to set up but offer no liability protection.

- LLCs involve more paperwork but shield your personal assets and offer some tax flexibility.

Thus, choosing between them depends on your business’s needs and risk profile:

- If you have a low-risk venture and simplicity is a priority, a sole proprietorship might be sufficient.

- If you value protection for your personal assets or have growth plans, an LLC for Amazon may be the better option.

Why Should You Have an LLC for Amazon?

LLC for Amazon sellers brings many benefits, the most prominent of which are:

- Asset protection

- Pass-through taxation

- Seller’s credibility and professionalism

- Management flexibility

We will break down each benefit to help you have the clearest answer to the question, “Do I need an LLC to sell on Amazon?”

1. Asset protection

One of the primary reasons to form an LLC for Amazon business is the protection it offers for your personal assets. Owning an LLC keeps a clear line between your business and personal finances. This means your house, car, and other personal assets are typically not at risk if your business encounters lawsuits or debts.

To help you get the answer to the question, “Do I need to have an LLC to sell on Amazon?”, below is a specific example:

You sell a used climbing rope that’s unknowingly weakened from sun damage. The buyer uses the rope while climbing, and it snaps, causing them to fall and get seriously hurt. You could be held liable for their injuries. If you operate as a sole proprietor and get sued, you could lose your personal savings to cover any damages awarded.

However, with an LLC, the lawsuit will only target the LLC’s assets, potentially including business inventory or profits. This will not impact your personal assets.

2. Pass-through taxation

Another significant advantage of having an LLC for Amazon sellers is the tax benefits it offers. By default, an LLC is considered a pass-through entity for tax purposes. This means that the business’s profits and losses flow through to the individual owner’s personal tax returns.

Pass-through taxation allows you to avoid the double taxation that corporations often face. In a corporation, the company’s profits are taxed at the corporate level, and then the dividends distributed to the shareholders are taxed again on their personal tax returns. With an LLC, you only pay taxes once, at the individual level.

Wondering, “Do you need an LLC to sell on Amazon? Here’s a specific scenario where the answer is a resounding yes:

Let’s say your Amazon business generates $100,000 in profit. You will pay taxes on the full $100,000 if you operate as a sole proprietorship. However, if you have an LLC, you can take advantage of deductions and only pay taxes on your individual share of the profits after deducting business expenses. This can result in significant tax savings.

3. Seller’s credibility and professionalism

LLC for Amazon can enhance your credibility and professionalism in the eyes of customers and potential business partners. When customers see that you have a registered business entity, such as an LLC, they perceive you as more trustworthy and reliable. This can lead to increased sales and customer loyalty.

Furthermore, forming an LLC allows you to establish a distinct business name. Instead of using your personal name as the seller, you can create a professional brand that resonates with your target audience. A well-thought-out business name and branding can make a lasting impression and help differentiate you from competitors. In the competitive world of Amazon, standing out is key to driving sales and, ultimately, making money.

4. Management flexibility

When your store is jointly owned by 2 or more people, do you have to have an LLC to sell on Amazon? Yes, you do. Now, let us explain why!

An LLC allows you more flexibility in managing your business. A sole proprietorship is, by definition, a one-person operation. An LLC, on the other hand, can have a single owner (a single-member LLC) or multiple members. This opens doors for future growth and collaboration.

For example, if you plan to partner with someone on your Amazon business venture, forming an LLC allows you to define ownership percentages, profit sharing, and decision-making processes within an operating agreement. This legally binding document protects everyone involved and avoids potential disagreements down the road.

Ready to streamline your Amazon business with multiple owners?

Ready to streamline your Amazon business with multiple owners?

How to Start an LLC for Amazon Store?

You’ve likely gleaned the answer to the initial question of “Do I need an LLC to sell on Amazon?” by now. If you’ve decided an LLC is the right path, here’s a breakdown of the 5 key steps to take:

- Step 1: Choose a business name

- Step 2: Appoint a registered agent

- Step 3: File articles of organization

- Step 4: Obtain a federal tax ID (EIN)

- Step 5: Create an operating agreement

Let’s delve deeper into each step to ensure a smooth LLC formation process for your Amazon venture!

Step 1: Choose a business name

This might seem like a simple task, but choosing the right name for your LLC is crucial. Here are some key points to remember:

- Availability: Conduct a name search through your state’s business filing office to ensure the name you choose isn’t already in use by another business.

- Relevance: Choose a name that reflects your brand and the products you plan to sell.

- Keywords (Optional): Consider including relevant keywords to your niche in the name to improve searchability.

- Rules and regulations: Be mindful of any naming restrictions in your state. For example, in California, the name of a Limited Liability Company (LLC) must include the words “Limited Liability Company” or the abbreviations “LLC” or “L.L.C.” Also, the name cannot contain words suggesting it is a corporation, such as “Incorporated,” “Inc.,” “Corporation,” or “Corp.”

- Domain name: Check for domain name availability to ensure a consistent brand presence online.

Step 2: Appoint a registered agent

Every LLC for Amazon needs a registered agent. This is an individual or service company that accepts legal documents on behalf of your business. The registered agent must have a physical address within the state where your LLC is formed and be available during regular business hours.

Here are some options for a registered agent:

- Yourself: If you’re comfortable receiving legal documents at your business address and are always available during business hours, you can act as your own registered agent.

- Family or friend: A friend or family member can be your registered agent, but ensure they understand the responsibilities and are always reachable.

- Registered agent service: Many companies offer registered agent services for a yearly fee. This can be a convenient option if you don’t have a physical business address or prefer not to use your home address for legal purposes.

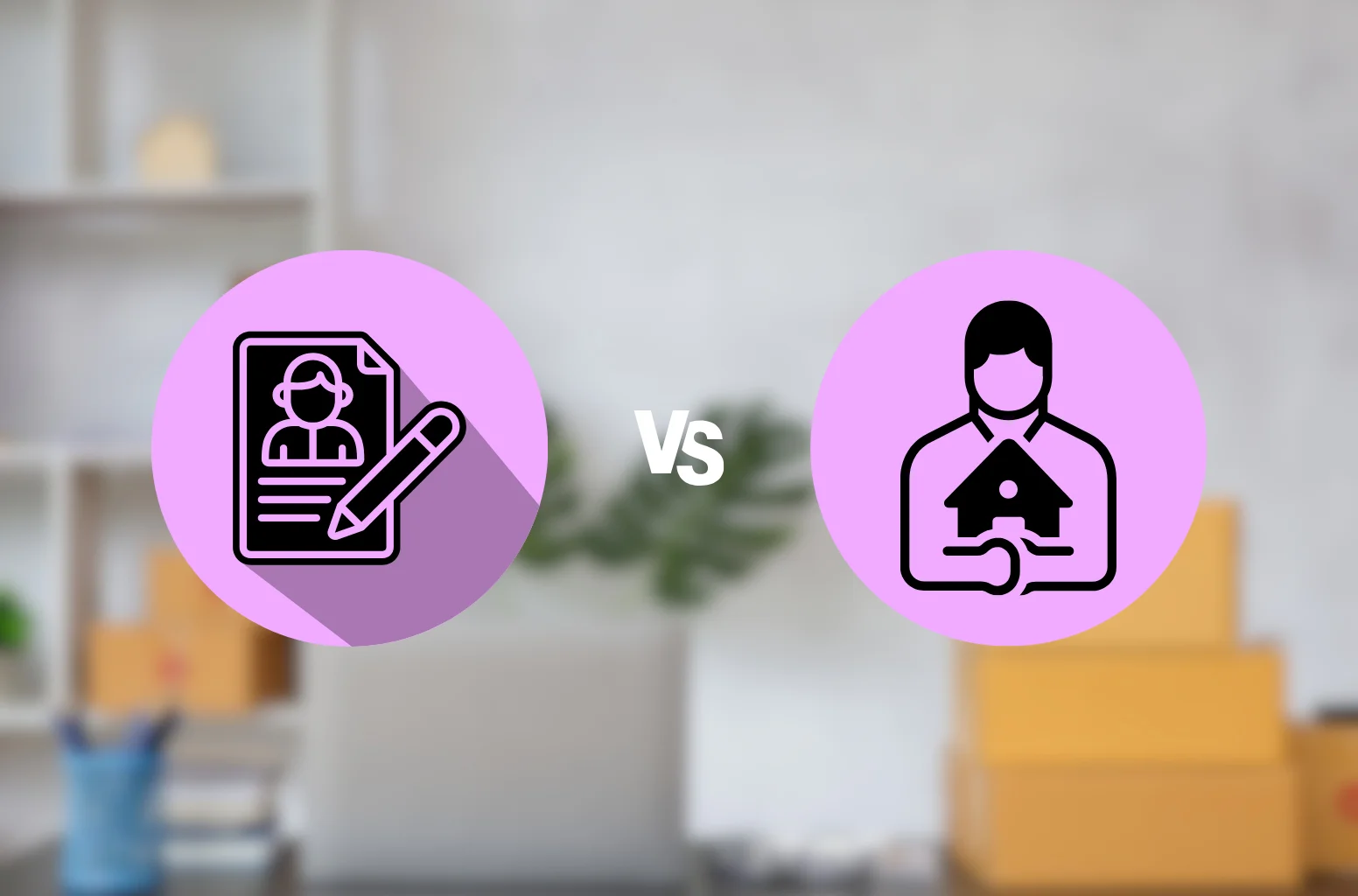

Step 3: File articles of organization

The Articles of Organization refers to the official document that formally establishes your LLC with the state. The filing process and specific requirements will vary slightly depending on your state. Here’s a general overview:

- Obtain the form: You can usually download the Articles of Organization form from your state’s business division website.

- Complete the form. The form typically requires information such as your LLC for Amazon name, registered agent details, and business purpose.

- Filing fee: Submitting the Articles of Organization will incur a filing fee. Your state’s website will provide the specific amount.

Step 4: Obtain a federal tax ID (EIN)

An Employer Identification Number (EIN) refers to a special number consisting of nine digits that is provided by the Internal Revenue Service (IRS). It serves multiple purposes, such as facilitating tax-related activities and allowing you to open a business bank account and hire employees.

Applying for an EIN is a straightforward process that can be done online through the IRS website. To ensure a smooth application, you need to make sure you have all the required information about your LL. These include its legal name, address, and the Social Security Number or Individual Taxpayer Identification Number of the responsible party.

Step 5: Create an operating agreement

Only California, Delaware, Maine, Missouri, and New York require LLCs to have an operating agreement. The rest of the states do not mandate an operating agreement. Some states don’t require them because they have default LLC statutes that come into play if there’s no operating agreement.

However, having one in place is highly recommended regardless of your state. This document outlines the internal governance of your LLC, including:

- Ownership percentages: This specifies how profits and losses are divided among the LLC members.

- Management structure: This details who will manage the day-to-day operations of the LLC.

- Member voting rights: This outlines how decisions will be made within the LLC.

- Distribution of profits and losses: This clarifies how profits and losses will be allocated among the members.

To start selling on Amazon, here are 2 more guides for beginners: Amazon Seller Fees – All costs of selling on Amazon in 2026 and How to Sell on Amazon: 5 Steps for Beginners [Latest Updated]

Having a well-defined operating agreement can help prevent future disputes and ensure the smooth operation of your Amazon business. While online operating agreement templates can be readily available, it is highly recommended to seek guidance from an attorney to ensure that they align with your unique requirements.

Top 5 Best Amazon LLC Filing Services

You know, yes is the final answer to the question, “Do I need an LLC to sell on Amazon?”. But is the process of filling an LLC causing you difficulties? Fortunately, several top-notch LLC filing services can streamline the process and get you selling on Amazon faster. Here are 5 excellent options to consider:

- LegalZoom (well-known for its user-friendly interface and comprehensive packages)

- Tailor Brands (combines LLC formation with branding services for a one-stop shop)

- Northwest Registered Agent (focuses on affordability and registered agent services)

- Inc Authority (known for speed and customer support)

- Incfile (offers a budget-friendly basic package)

1. LegalZoom

✅ Rating on Trustpilot: 4.3

✅ Price: From $0 to $299

A household name, LegalZoom offers a user-friendly platform to form your LLC. They guide you through the filing process, provide state-specific filing fees, and offer optional add-on services like an Operating Agreement and registered agent services. However, LegalZoom’s pricing can be on the higher end compared to some competitors.

2. Tailor Brands

✅ Rating on Trustpilot: 4.5

✅ Price: N/A

Beyond just LLC formation, Tailor Brands offers branding tools like logo design and website creation. This can be a great option for entrepreneurs who want a one-stop shop for establishing and presenting their brand. Keep in mind that their core LLC filing package might lack some features offered by dedicated LLC services.

3. Northwest Registered Agent

✅ Rating on Trustpilot: 3.2

✅ Price: From $39

While their name suggests a focus on registered agent services, Northwest Registered Agent also provides affordable LLC filing packages. They offer basic and comprehensive formation options, catering to both budget-conscious and feature-seeking businesses. Additionally, their customer service is known for being responsive and helpful.

4. Bizee

✅ Rating on Trustpilot: 4.7

✅ Price: From $0 to $299 + any state filing fees

Bizee stands out for its speed and simplicity. They offer a streamlined LLC formation process at a competitive price. While they don’t provide extensive add-on services, Bizee focuses on getting your LLC filed quickly and efficiently. This can be ideal for those who want a hassle-free formation experience.

5. Inc Authority

✅ Rating on Trustpilot: 4.7

✅ Price: From $0 to $299 + any state filing fees

Inc Authority offers a good balance between affordability and features. Its basic package covers the essential LLC formation needs, while its higher tiers include add-ons like business document templates and compliance monitoring. Plus, it has a user-friendly interface and helpful customer support.

Do I Need an LLC to Sell on Amazon: FAQs

No, you do not need an LLC to sell on Amazon FBA. You can start selling immediately under your name as a sole proprietor. However, forming an LLC can offer several advantages and protections for your business in the long run. It’s important to consider factors such as liability protection and future scenarios like customer lawsuits when deciding whether to form an LLC. Indeed, it is possible to sell on Amazon without having an LLC. As a U.S. citizen, you can create an Amazon account as a sole proprietor. Nevertheless, establishing an LLC can offer both financial and legal protection, making it a worthwhile consideration if you are committed to launching a business. Including “LLC” in your Amazon store name is not necessary. When selling on Amazon, you can use your name as a sole proprietor without the need for an LLC. However, if you have formed an LLC for your business, you may choose to include it in your store name for branding purposes or to convey a sense of professionalism. No, you do not need an LLC to sell merchandise on Amazon. It is possible to begin selling right away as a sole proprietor. However, forming an LLC can provide advantages and protections for your business, so it’s worth considering. It’s important to consult with legal and tax professionals to decide the best legal structure for your specific situation. No, Amazon itself doesn’t require a business license to open a seller account but you might still need one depending on your location and business structure. Here’s a breakdown:

The Bottom Line

Do you need an LLC to sell on Amazon? No, but it offers significant advantages for your business.

While you can start as a sole proprietor for simplicity, an LLC separates your personal assets from business liabilities, provides tax flexibility, and enhances your credibility. If you plan on growing your Amazon business or have multiple owners, an LLC is the way to go.

To stay up-to-date with the latest trends and insights in the eCommerce industry, follow Amazon blog developed by LitCommerce. By doing so, you’ll have access to exceptional eCommerce business insights that can be shared with fellow entrepreneurs daily.

And in case you have any questions, feel free to consult with us any time. We’re more than happy to help!