What Are eBay Selling Taxes?

When first opening an eBay store, you might wonder if you must pay any eBay selling taxes. In most cases, the answer is Yes.

As explained in detail, eBay taxes refer to all taxes that sellers are obligated to pay when selling their products on this top marketplace. Based on eBay tax documents, there are five typical taxes, which include:

- Internet sales tax.

- eBay income tax.

- Value Added Tax, Goods and Services Tax, and so on.

- Taxes on eBay fees.

- Taxes for sold and bought products.

Back to our eBay selling tax definition, the marketplace only collects and remits taxes based on the cost of the item. On the other hand, sellers are responsible for reporting their income earned from eBay sales for tax purposes.

Now, to gain you a deeper understanding of this topic, we’ll walk you through the details of 5 mentioned tax types right below!

5 Different Types of eBay Seller Taxes

Many of you might be wondering: Does eBay charge sales tax? Yes, it does. As a matter of fact, taxes contribute a part to eBay fees for selling. Sellers are subject to different types of taxes depending on where and what they sell.

Here are types of eBay selling taxes with detailed information:

- Internet sales tax

- eBay income tax

- Value Added Tax, Good Service Tax

- Tax on eBay fees

- < Tax on eBay sold and bought items

Located and selling in the US, you are responsible for eBay sales and income taxes. When you sell your product outside the US, remember that VAT and GST are the equivalent of sales tax. While VAT is a consumption tax applicable in the European Union (EU) and the United Kingdom (UK), the Goods and Services Tax (GST) is obligated in Australia and New Zealand.

1. Internet sales tax

The first eBay tax that might come up to your mind when you sell to US-based buyers is the Internet Sales Tax. In the US, you must collect and remit Internet Sales Tax on your transactions while selling on most marketplaces.

Notably, eBay currently collects sales tax on orders shipped to buyers in 46 US states, with exceptions for New Hampshire, Oregon, Montana, Alaska, and Delaware, and the sales tax rate varies by state. However, the seller does not have to pay internet sales tax. This eBay selling tax is a pass-through tax usually paid to you, and you hold that until time to file a tax return. Simply put, eBay internet sales tax doesn’t come out of your pocket but passes from the buyer to the tax authority through you.

2. eBay income tax

Speaking of essential eBay selling taxes, you are most likely subject to income tax. Unlike internet sales taxes, eBay income tax comes directly from your pocket and depends on your income. Each year, you have to report your payment using a form.

Regarding factors that impact your income tax, you might want to count on your overall income, expenses, and applicable tax rates. Furthermore, there is no eBay sales tax calculator. Hence, it is advisable to keep detailed records of your sales, expenses, and applicable deductions to ensure accurate reporting.

3. Value Added Tax, Goods and Services Tax

If you want to boost your eBay sales, expanding your reach beyond your own country is an option worth considering. However, when you sell outside the United States, the taxation landscape can vary due to regional regulations and international laws.

Let’s explore how international taxes for selling on eBay differ from domestically.

- VAT: If you sell to buyers in the UK or European Union (EU), you may be subject to VAT obligations. VAT is a tax on a business’s gross receipts from the sale of goods and services. As an eBay seller, you should register for VAT, charge VAT on your sales, and submit periodic VAT returns to the relevant tax authority.

- GST in Australia and New Zealand: In Australia and New Zealand, one of the applicable eBay selling taxes is known as Goods and Services Tax (GST). In Australia, if you sell, or expect to sell, over 75,000 AUD to Australian customers within 12 months, you have to directly remit Goods and Services Tax (GST) to the Australian Taxation Office (ATO) through the Simplified GST for Importers process.

- Value Added Tax (VAT) on eCommerce in Norway: Norway has specific rules regarding VAT on online transactions involving eBay tax information. In particular, if your sales to Norwegian customers exceed the applicable threshold, you may need to register for VAT in Norway, charge VAT on your sales, and fulfill the related reporting and payment obligations.

Beyond the mentioned regions, different countries may have tax systems and requirements for eBay sellers. These include sales tax, GST, VAT, or other consumption-based taxes. Researching and understanding the tax obligations in each country where you sell on eBay is crucial. By any means, you should stay on the right side of the law, which doesn’t exclude cases of your eBay selling taxes.

You may also like to read: eBay Prohibited Items List Sellers Must Know.

4. Tax on eBay fees

Depending on the seller’s location, Value Added Tax (VAT), Goods and Services Tax (GST), or similar consumption taxes may apply to your overall selling fees. In some cases, this can lead to you having eBay fees too high. If eBay must collect these taxes in your jurisdiction, they will either add the tax as a separate charge on your seller invoice or include it in their fees.

To ensure accurate taxation, updating your registration address on eBay is vital. Accordingly, this allows eBay to determine your location and apply the appropriate tax regulations. Apart from ensuring that you comply with eBay sales tax requirements, updating your address facilitates smooth transactions on the platform.

5. eBay selling taxes on sold and bought items

The final answer to “How much is eBay tax” must not go without the extra amount one pays for sold and bought items. This eBay selling tax involves VAT and GST, which we have previously mentioned. However, the applied rules don’t stay the same.

To begin with, different countries and jurisdictions worldwide have specific regulations applied to consumption goods and services. Regarding the case, eBay sold and bought items are no exceptions. In accordance with this rule for eBay selling taxes, the marketplace states such tax practices will ensure sellers comply with the laws.

Now, let’s get the details of eBay taxes on items sold and bought!

Items traded in the US

- Sellers pay tax on eBay sales, following state regulations. They also have the right to charge the same extra amount for each item traded within the US. However, in any case, sellers put on an additional charge; they must provide eBay with permits or equivalent documentation that authorizes their actions.

- Due to applicable tax laws, eBay will calculate, collect, and remit sales tax on items shipped to certain states on behalf of sellers.

Items traded outside the US

- As we have previously stated, eBay’s selling taxes outside the US involve general VAT and GST obligations.

- In terms of eBay seller tax on bought and sold items, sellers and buyers might be subject to regulations and laws taking effect in each country.

- Items sold to countries, including Australia, New Zealand, Norway, Kazakhstan, and Belarus, are required a certain amount of taxation. Furthermore, eBay’s tax amount collected and remitted might depend on the order value.

Who Has to Pay Taxes on eBay Sales?

Do you pay tax on eBay? Surprisingly, it depends!

According to the rulebook, not every seller is subject to paying eBay selling taxes. The obligations to pay taxes on eBay sales depend on the kind of seller and the nature of their store.

In particular, sellers on eBay can be divided into three types: business sellers, online garage sellers, and hobby sellers. Each type of seller has a distinct selling purpose. While online garage sellers use eBay to tidy up their houses, business sellers aim to profit. Hence, it’s essential to understand those conditions to determine your tax obligations on eBay.

1. Business sales are 100% taxed

First, money-making businesses are 100% taxed. If you use eBay as a platform for selling products to run a profitable business, your venture is regarded as a legitimate business. On those grounds, you must pay taxes on eBay sales generated from your store.

2. Online garage sales aren’t taxed

On the contrary, online garage sales don’t get taxed on eBay. These sales typically involve personal belongings like clothing, electronics, furniture, and other household items. Moreover, sellers of these stores only consider these sales as a means to declutter their homes, earn some extra money, and just open them once or occasionally. These online garage stores don’t function as businesses and won’t have to pay eBay selling taxes.

However, it’s important to note that if the occasional sales become regular or the seller starts buying items for resale, it could be considered a business. In those cases, eBay will apply its taxation rules.

3. Hobby sales are taxed

There is a kind of store between online garage sales and money-making businesses known as hobby stores. These shops are run by casual sellers who use eBay more frequently than occasional sellers to make a profit. Therefore, they have to pay eBay’s selling tax.

While understanding and managing your tax obligations as an eBay seller is crucial for maintaining a compliant and profitable business, it’s equally important to recognize that your sales volume and revenue potential may be constrained by eBay’s selling limits, which are designed to ensure seller reliability and platform integrity.

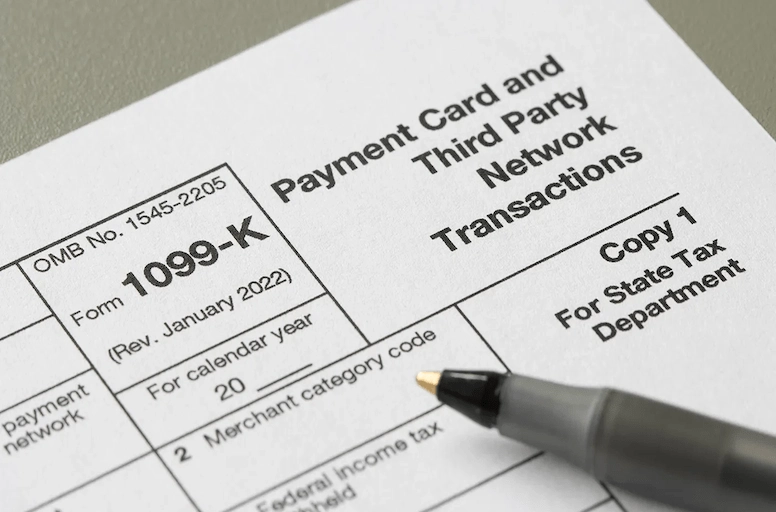

Now that we have gone through what types of eBay taxes are and who pays for them, let’s delve into details about the 1099-K eBay form!

How to File Your eBay Taxes?

Before you pay your eBay selling taxes, you need to file them using one of eBay’s tax forms. Specifically, eBay lets sellers use the 1099-K and 1099-MISC to generate information related to taxation duties. However, the 1099-K eBay form serves you more as a taxation filing document. Meanwhile, the 1099-MISC is useful for cases in which you pay or receive amounts that aren’t related to sales revenue.

Now, follow these steps to download your 1099-K detailed report in Seller Hub:

- Access Seller Hub and navigate to the Payments tab.

- On the left-hand menu, click on Taxes.

- Choose the option for 1099-K details.

- Select the Generate button.

If you are not downloading your eBay sales report for taxes from Seller Hub, here are the steps to generate it using My eBay:

- Visit My eBay and go to the Payments section.

- Scroll down until you find Payment reports and taxes.

- Click on Form 1099-K.

- Choose the option to request a detailed eBay 1099-K report.

Apart from the eBay 1099-K form, you might have to report your income using Form 1040, Schedule C. Except for online garage sellers who aren’t paying eBay selling taxes, and this rule applies to business sales and hobby sales.

While navigating the complex landscape of eBay selling taxes is crucial for maintaining compliance and avoiding potential legal issues, it’s equally important for sellers to familiarize themselves with eBay’s Seller Protection policies, which offer a safety net against various risks such as item not received claims, significantly not as described cases, and certain types of chargebacks.

A Guide to Master Your eBay Taxes – FAQs

- 1. Do you have to pay taxes on eBay sales?

Whether or not you have to pay taxes on eBay sales depends on why you are selling. Keep in mind that eBay selling taxes are not applicable to all sellers. However, if you run a business and make money by selling your products on eBay, then you will definitely have to pay taxes. Here are the taxes you need to keep in mind when selling on eBay:

- Internet Sales Tax

- eBay Income Tax

- Value Added Tax (VAT)

- Goods and Services Tax (GST)

- Taxes on eBay fees

- eBay selling taxes on sold and bought items

- 2. How much is eBay income tax?

Your eBay income tax is highly dependent on your net income, which is generated by making sales on eBay. This might also relate to your overall sales revenue. Yet, simply put that the more you make from sales on eBay, the higher your income tax becomes.

- 3. How to avoid paying taxes on eBay sales?

Avoiding tax on eBay sales unlawfully is not recommended. However, you can minimize your tax liability by properly tracking and deducting eligible business expenses and consulting with a tax professional for personalized advice.

- 4. What happens if I sell more than $600 on eBay?

If you sell more than $600 on eBay in a calendar year in the United States, eBay must report your sales information to the IRS using Form 1099-K. It is essential to report your income on your tax return accurately.

- 5. How much can I sell on eBay without paying tax?

The threshold for paying taxes on eBay sales varies depending on your jurisdiction’s tax laws. It is advisable to consult with a tax professional or refer to the tax regulations in your specific location for accurate information.

- 6. Will I get a 1099 from eBay?

Yes, you will get a 1099-K form from eBay. In fact, you can download this eBay tax form from Seller Hub or My eBay.

Is There A Tax on eBay – Final Words

Does eBay charge tax? Yes, ABSOLUTELY!

As an eBay seller, you can enjoy numerous benefits of having an eBay store. However, it is crucial to pay attention to the importance of eBay selling taxes. Different types of sellers have varying tax obligations, such as business sellers, online garage sellers, and hobby sellers.

Depending on their sales location, eBay sellers may be subject to Internet sales tax, income tax, VAT, GST, etc. Accordingly, properly managing income and expenses, as outlined in Form 1099-K, 1044, is essential for accurate eBay tax filing.

In any case, if you feel eBay is overcharging selling taxes and want to go live on more sales channels, message us or join our community. That’s everything we’ve got for this topic. All in all, enjoy reading the LitCommerce Retailer Blog!