As you’ve decided to sell your products to a best selling platform – Walmart, you should be aware of the Walmart marketplace fees. Knowing the cost like the back of your hand helps you price your products for a better margin and avoid operating at a loss.

The great news is that Walmart owns a lot less complex fee system compared to other platforms like Amazon and eBay. Nevertheless, you are subject to paying other types of additional fees as a US-based seller. Understanding such concerns, we’ll be providing you with all the details regarding:

- Walmart marketplace fees

- How sellers get paid on the Walmart marketplace

- Walmart marketplace sales tax

- Pricing an item on Walmart

Let’s get down to business!

How Much Does it Cost to Sell on Walmart Marketplace?

Unlike Walmart competitors that charge listing fees and account fees, Walmart marketplace selling fees only count when you sell. It means your business bears no cost if it is not selling anything. Walmart does not charge setup, subscription, or monthly account fees when selling on its marketplace.

Read more:

Every time you succeed in delivering an order, you are subject to paying a Walmart referral fee. This is a commission that you pay to Walmart and it is counted as a percentage of your product’s selling price.

Nevertheless, the costs of selling on Walmart marketplace vary depending on the item category you are selling. The referral fees are marked up from 8% to 15% of the item price. Here is a detailed percentage breakdown of this fee across different product categories.

Product Category | Referral Fee Percentage |

Personal Computers | 6% |

Camera & Photo | 8% |

Plumbing, Heating, Cooling & Ventilation | 10% |

Automotive & Powersports | 12% |

Apparel & Accessories | 15% |

Tools & Home Improvement | 15% (except 12% for Base Power Tools) |

Outdoor Power Tools | 15% for items with a total sales price ≤ $500 |

Watches | 15% for the portion of the total sales price up to $1,500 |

Electronics Accessories | 15% for the portion of the total sales price up to $100 |

Indoor & Outdoor Furniture | 15% on the first $200, 10% on amounts > $200 |

Jewelry | 20% for the portion of the total sales price up to $250 |

Baby | 8% for items with a total sales price of $10 or less |

Beauty | 8% for items with a total sales price of $10 or less |

Grocery | 8% for items with a total sales price of $10 or less |

Health & Personal Care | 8% for items with a total sales price of $10 or less |

Sell on Walmart and More

Sell on Walmart and other channels at a time with LitCommerce. Sync your listings, inventory, and orders of all your sales channels!

How Sellers Get Paid When Selling on Walmart?

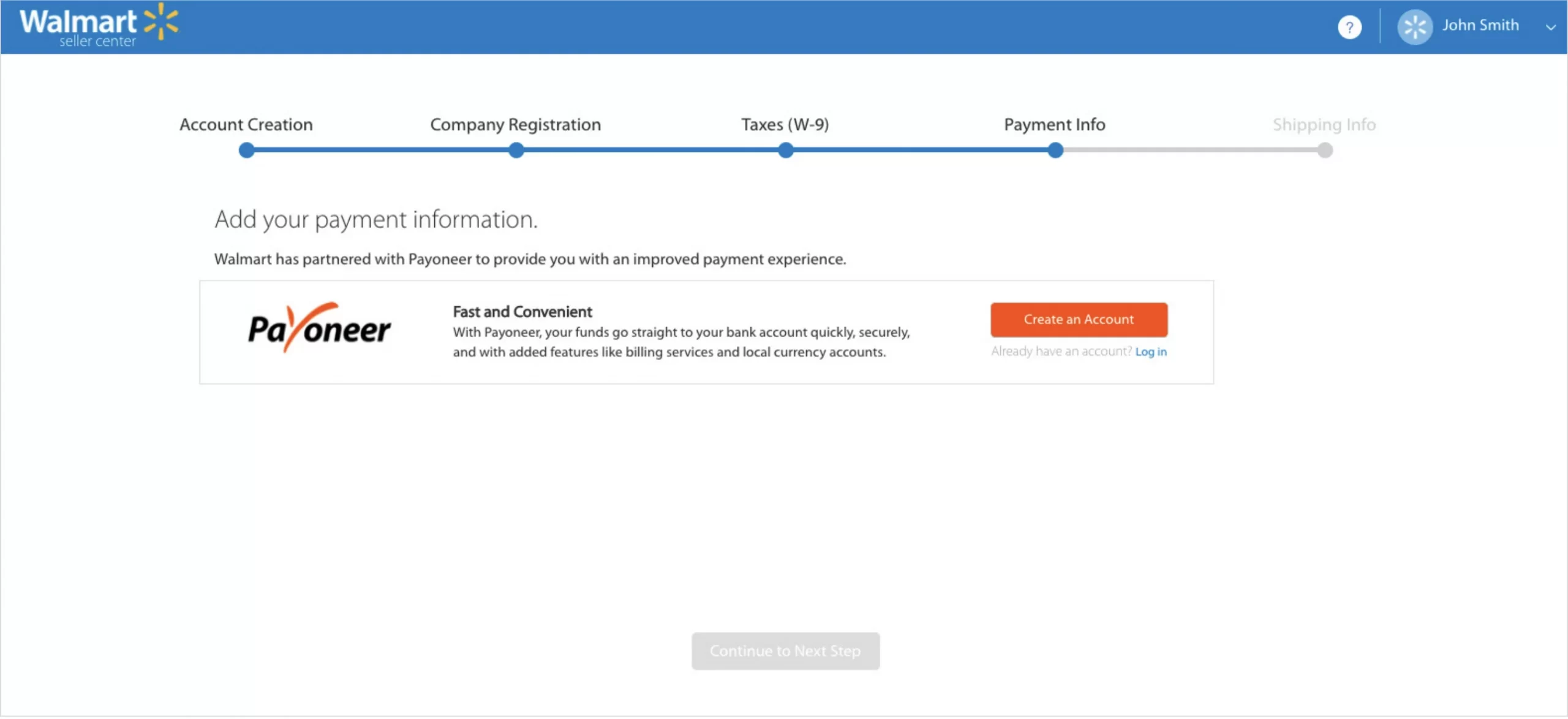

Walmart pays its sellers using the Payoneer payment gate. If you already have a Payoneer account before Walmart seller registration, you can link it during your setup process. If not, you should create one indirectly via the registering page when setting up your Walmart account.

Wondering why? Here’s the answer.

You have to pay a transaction fee when linking your existing Payoneer account that’s created outside Walmart’s seller setup page. This is an automatically deducted fee for every transfer later on. You can contact Payoneer’s supporting team for a refund, yet you have to do it every time making a transfer. Meanwhile, when you sign up for Payoneer during your Walmart setup process, there will be no fee for transactions from Walmart.

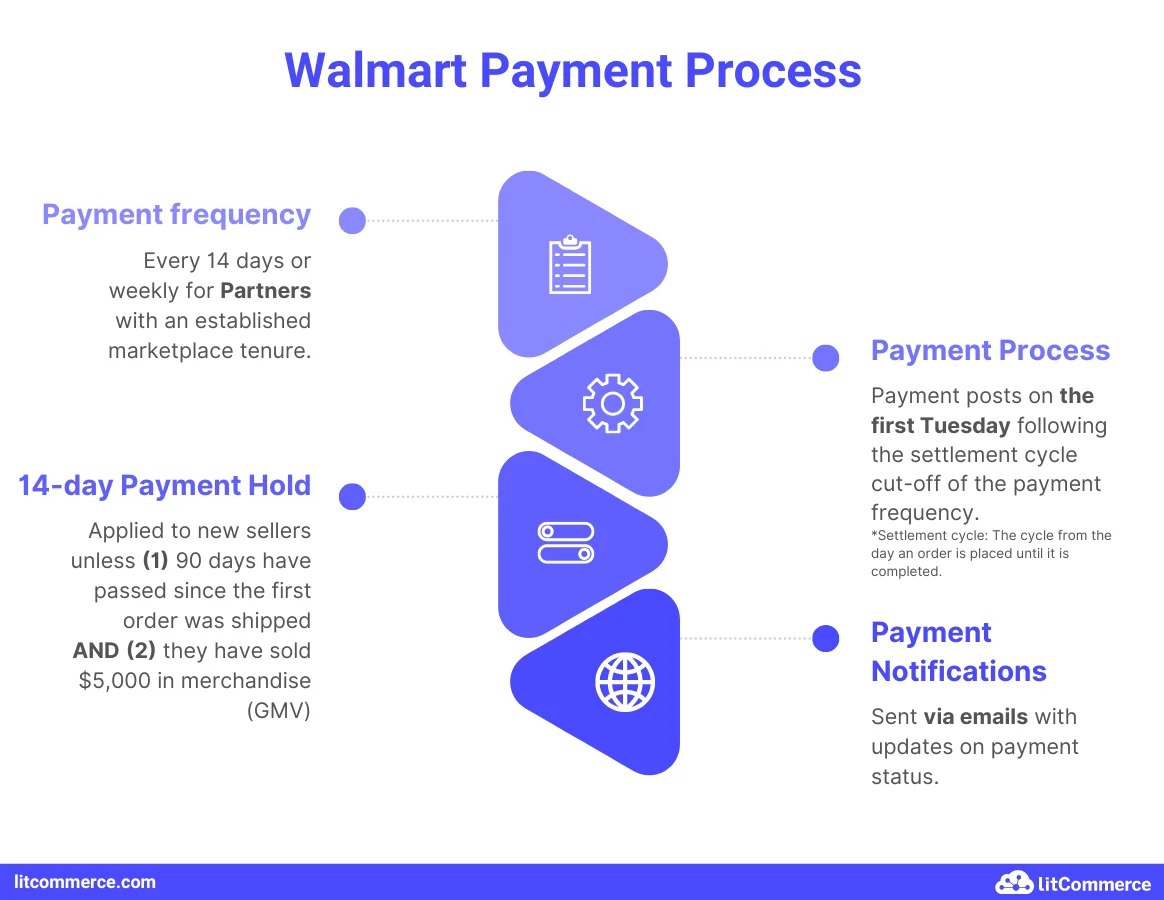

When your seller account is approved by Walmart, your payment frequency will be bi-weekly (every 14 days). Sometimes, payment delays will happen due to high return/chargeback rates and the selling of counterfeit/illegal items. Payments post on the first Tuesday following the settlement cycle cut-off. You will receive an email notification for this.

However, you may experience a payment hold of 14 days as a new seller. The timeframe of this hold may vary and be effective until

- 90 days after your first successful order;

- and you have made $5,000 in merchandise.

Here’s an example for you to picture the process:

You started selling on Walmart on Tuesday, Nov 1st, 2022 and shipped 15 orders from Nov 1st – Nov 12th, 2022. Payment would deposit on Tuesday, Nov 29th, 2022.

Walmart Marketplace Sales Tax

Despite not being a compulsory step when establishing a Walmart seller account, it’s highly recommended to configure online sales tax. Sales tax settings include tax nexus, shipping sales tax codes, and sales tax policy. Walmart helps sellers handle the collection of taxes using its pricing algorithm.

Nevertheless, here are two key aspects determining Walmart taxes and fees.

Items purchased from Walmart Marketplace

As a third-party seller on the Walmart marketplace, you are responsible for including the tax codes when pricing your items. Also, you can add the tax amount to the price or display it separately. By configuring tax codes, Walmart will help you remit sales tax on your behalf in 47 states under enacted state laws, except Missouri.

Walmart provides sellers with a detailed tax code sheet you can download directly from its Seller Help Central. Nevertheless, it doesn’t offer consultation over what tax codes should be in use, and you need to contact your tax advisors for this matter.

You can set up your tax configuration by following the steps below:

- Setting up the Tax Nexus in Partner Profile – indicating what state sales tax should be collected.

- Include Shipping Sales Tax Codes to account for shipping method taxes (Standard, Expedited, NextDay, Freight, and White Glove Shipping).

- Provide your Sales Tax Policy – including relevant sales tax codes for individual items in your item feeds.

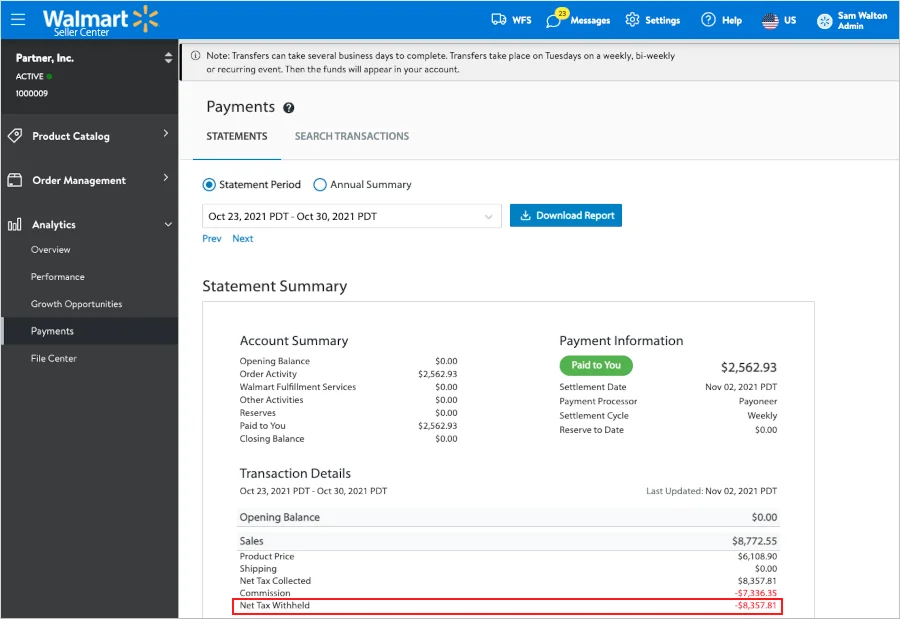

You can always see how sales tax is collected on your behalf using the Statement Period available under the Analytics section.

Items purchased directly from Walmart.com

For items purchased directly from Walmart.com, tax is only applicable to shipping items to US states, territories, and protectorates. There is no tax charge when shipping items to an FPO/APO military address. It also depends on the present norms that a certain amount of tax will be charged.

Moreover, shipping and packaging might be subject to taxes in certain states. There will be a tax refund following the return of any order.

It’s important to note that Walmart Gift Cards purchased from Walmart stores or its official website is not taxable.

Key Highlights When Pricing an Item on Walmart

When taking sales tax and Walmart marketplace selling fees into account, there are a few tips to pocket for a better product margin.

Every factor counts

You should consider every factor that might affect your product price and profit margin. Take the following factors as a reference for your Walmart pricing strategy:

- Sales tax

- Walmart shipping cost

- Walmart marketplace fees

- Labor cost

- Return costs

- Overhead cost (bills, tools, advertisements, etc.)

To save up on Walmart Marketplace fees, you can go for items with a high conversion rate yet a low charge fee. Walmart marketplace fees start as low as 6% for products under the personal computer category, which can be a deal for you.

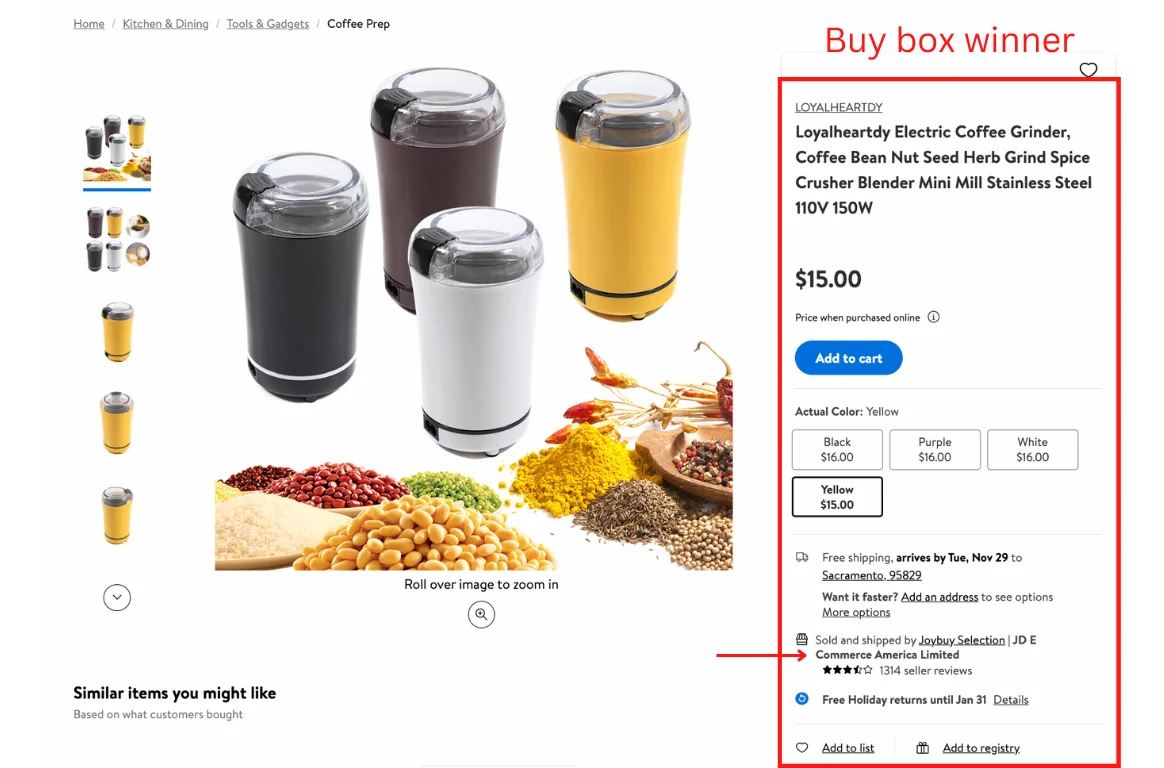

Customers are more likely to buy products from Buy Box winners. Therefore, you can also increase the conversion rate and the number of sold items by winning the Buy Box. Here’s how:

- Offer a competitive pricing point.

- Maintain proper stock availability

- Offer free shipping or keep the shipping price at the lowest possible

- Ensure on-time product delivery

- Gain positive product reviews from customers

Walmart price policies matter

You should ensure that your item prices adhere to the Walmart pricing policy. If not, the platform can suspend your listings or remove them completely.

Here are a few things to keep in mind:

- Price an item for a consistent amount across different platforms if you are selling on multiple channels. Walmart will unpublish listings automatically from its marketplace if customers tend to save some money by buying the same product from the same seller but on other competing marketplaces.

- Price your items the lowest possible. Walmart will unpublish listings automatically from its marketplace if customers tend to save significantly by buying an item on other competing marketplaces, regardless of the seller.

Walmart Marketplace Fees – FAQs

- What percentage does Walmart Marketplace take?

Walmart marketplace fees start from 6% and can go up to 15% of the total sales price. The exact Walmart marketplace seller fees will depend on the specific item categories. Ideally, you can see the details by checking the categories and the fee accordingly.

- What is the difference between Walmart com and Walmart Marketplace?

The main difference lies in the suppliers. For items sold on the Walmart marketplace, Walmart will partner with third-party eCommerce sellers. Meanwhile, Walmart.com items will be Walmart-owned items.

- Is it easy to sell on Walmart Marketplace?

Applying as a seller on Walmart’s Marketplace is simple. With all the required documents ready, the sign-up form only takes you around 15 minutes to fill in all the details. Nevertheless, you must submit your registration documents for approval from the platform.

Conclusion

All in all, you stand a better chance at winning over your competitors when you know the rules inside out. With an in-depth understanding of Walmart marketplace fees and sales tax, you can now implement more effective Walmart pricing strategies for better revenue.

You can also stay ahead of the game by scaling to other marketplaces! Litcommerce is an app that helps you scale easily and manage your sales channels effectively. Learn more about how we can help by contacting us, following our Retail Blog or joining our eCommerce community for the latest updates and interesting tips!