Selling on Walmart vs Amazon: Which marketplace is right for you? Well, Amazon and Walmart are the two most prolific eCommerce marketplaces in the U.S., with an enormous amount of monthly visitors. Amazon.com attracts 2.3 billion US visits each month, while Walmart.com receives nearly 400 million.

As Walmart closes in on Amazon’s dominance, understanding the key differences between these platforms is crucial for online sellers. In this comprehensive comparison, I will examine seven key factors that differentiate Amazon and Walmart to help you determine the best fit for your business:

1. Market size & customer base

2. Competitiveness

3. Selling Fees

4. Seller Policies

5. Product Types

6. Shipping & Fulfillment Services

7. Branding & Advertising

Unlock the Power of TWO Marketplaces!

Double your reach, simplify your listings, and skyrocket your sales with seamless Walmart & Amazon integration. Don’t miss out on untapped potential

Walmart vs Amazon: Market Size & Customer Base

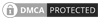

Amazon

Amazon’s market size is substantial and continues to grow. Amazon’s total annual revenue in 2023 was $574.79 billion. Amazon’s annual revenue from eCommerce only in 2023 was approximately $231.87 billion. Amazon dominates the eC-commerce market, capturing nearly 48% of all online sales in the US, with global retail eC-commerce sales projected to reach $729.76 billion in 2022, with the US accounting for $445.31 billion of that share, which is 41.8% of the total American eC-commerce sales.

These figures demonstrate Amazon’s dominance in the eCommerce space and its ability to continue expanding its reach and influence in the global market.

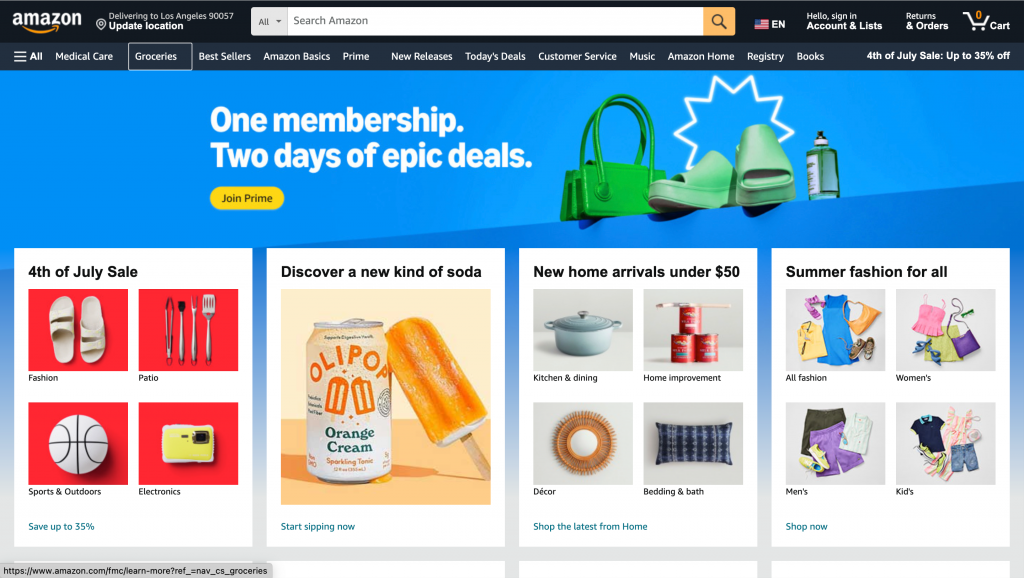

Walmart

When comparing Walmart marketplace vs Amazon, Walmart is the larger overall retailer, with total revenue of $611.3 billion in 2023 compared to Amazon’s $574.79 billion. While Walmart reigns supreme in total revenue, Amazon dominates the online marketplace. In 2023, Walmart’s online sales reached $648 billion, significantly lower than Amazon’s $138 billion.

Walmart’s strength lies in its extensive brick-and-mortar footprint, with over 4,607 domestic stores and 10,607 retail units globally, giving it a major advantage in the grocery and essential goods markets.

While Amazon leads in eCommerce, Walmart is quickly gaining ground and now accounts for 6.4% of US online sales in 2023, up from 5.4% in 2019. Walmart’s online grocery and delivery services have been a major driver of its eCcommerce growth.

In Q4 2023, Amazon captured 4.4% of U.S. consumer spending, while Walmart had 3%. While Walmart’s share has remained mostly flat since early 2021, Amazon has shown growth, particularly in online sales and discretionary categories like home furnishings, electronics, personal care, and clothing. However, Walmart’s overall performance is still notable, and together, the two retailers accounted for 6.5% of all U.S. consumer spending in 2023.

Verdict: Amazon dominates eCommerce but Walmart remains the larger overall retailer, with both platforms aggressively competing to expand their presence in the other’s core markets.

Walmart vs Amazon: Competitiveness

Amazon

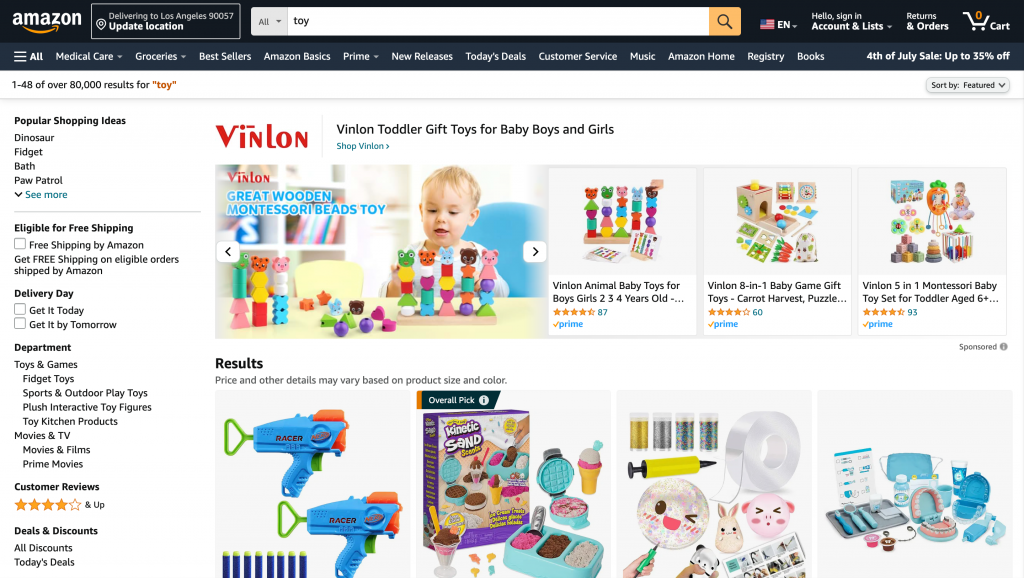

The Amazon marketplace is highly competitive, with over 2 million active sellers as of 2023. This massive seller community creates a challenging environment for individual merchants to stand out and gain visibility.

Amazon’s customer base of over 310 million users worldwide provides immense sales potential but also intense competition to capture those shoppers. Sellers must employ sophisticated strategies around keywords, product listings, pricing, and marketing to navigate the Amazon landscape effectively.

The platform’s algorithm-driven search and Buy Box systems further intensify the competitive dynamics as sellers vie to optimize their offerings to outperform rivals. While the sheer size of the Amazon marketplace presents opportunities, it also requires sellers to constantly analyze their competitors, refine their tactics, and innovate to stay ahead of the curve.

Walmart

In contrast to Amazon, the Walmart Marketplace is significantly less competitive, with only around 150,000 active sellers as of 2023. This smaller seller community provides more opportunities for individual merchants to gain visibility and market share.

As one of the biggest Amazon competitors, Walmart’s eCommerce platform has seen rapid growth, with its online sales reaching $82.1 billion in 2023 and accounting for 6.4% of the US eCommerce market. However, Walmart’s marketplace is still dwarfed by Amazon in terms of total sales and customer base.

Nonetheless, Walmart’s strong brick-and-mortar presence, growing online capabilities, and reputation for value provide a compelling alternative for sellers looking to diversify beyond Amazon. While competition is less intense on Walmart Marketplace, sellers must still focus on optimizing their product listings, pricing, and marketing strategies to stand out and capitalize on Walmart’s expanding eCommerce footprint.

Verdict: Overall, while both platforms offer opportunities for sellers, the competitiveness of the Amazon marketplace requires a more sophisticated approach, with a focus on optimization, marketing, and logistics. Walmart’s lower competition and strong physical presence can be advantageous for certain sellers, but the platform’s rigidity and pricing pressures present their own set of challenges.

Walmart vs Amazon: Selling fees

Amazon

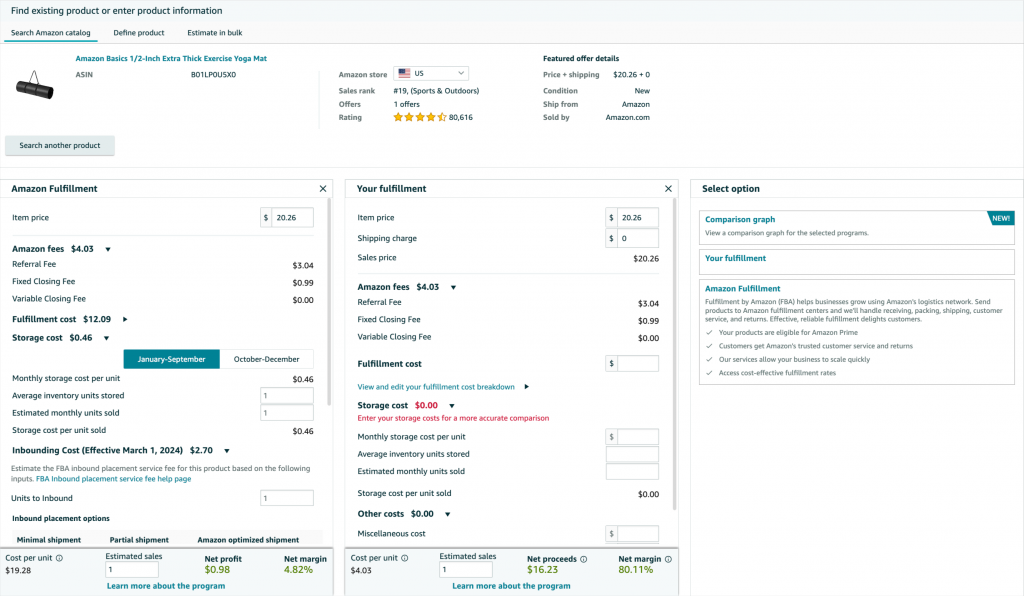

When weighing selling on Amazon vs Walmart, Amazon owns a more complex fee system with all kinds of fees.

Selling on Amazon fees include:

- Seller plans. There are two seller plans: Individual plan and Professional plan. There’s no listing fee on Amazon, and you only pay $0.99 for each item sold on an Individual plan. With a professional plan, you must pay a monthly amount of $39.99.

- Sales fee. The fees include a per-item fee, referral fee, closing fee, and high-volume fee. The platform charges the same for both account plans. You must foot the bill for 6%-45% of the selling price for the product referral fee, $1.80 per media item for the closing fee, and $0.005 on items over 100,000 in listing volumes.

- Amazon FBA fees. Three criteria for deciding the cost of Amazon fulfillment service (FBA) are the Size tier, Max dimensions, and Unit weight. The platform sets specific rules for different products and categories (i.e non-apparel, special oversize, etc.). Hence, we have the official Amazon Revenue Calculator that can estimate rough cost and revenue.

- Storage fee. Amazon’s storage fee per cubic square foot is $0.69 per month for Q1-Q3 and $2.40 per month for Q4.

Check out our in-depth analysis of Amazon seller fees to calculate how much you can pay when selling on Amazon.

Walmart

How much does it cost to sell on Walmart? Unlike Amazon, you don’t have to pay an account fee when you sell products on Walmart marketplace. Signing up for a seller account is free and you receive unlimited access to listings and categories.

In terms of sales fees, you have to pay Walmart selling fees when having items sold via the marketplace. It is also known as the product referral fee. Depending on the product categories, the amount ranges from 6% to 20% of the selling price.

For fulfillment, you can either self-fulfill your order or use Walmart’s fulfillment service (Walmart WFS). Walmart Marketplace sets transparent requirements for maximum product package sizes and weights for products sent to its fulfillment center.

Period | Cost |

January – September (Q1 – Q3) | $0.75/cubic foot monthly |

October – December (Q4) | – $0.75/cubic foot monthly for storing items within 30 days – An additional $1.50/cubic foot monthly (total: $2.25/cubic foot per month) for storing items for more than 30 days |

The last bill on the list is the storage fee. Walmart storage fees vary between two periods: From Q1 to Q3, and Q4. Overall, Walmart charges the same amount as Amazon does from Q1 through Q3, but less than Amazon does during Q4.

Period | Cost |

January – September (Q1 – Q3) | $0.75/cubic foot monthly |

October – December (Q4) | – $0.75/cubic foot monthly for storing items within 30 days – An additional $1.50/cubic foot monthly (total: $2.25/cubic foot per month) for storing items for more than 30 days |

Verdict: If you are on a tight budget for your business operation, Walmart might a better choice with much less cost and expense. However, you might not make as much on Walmart vs Amazon when Walmart site visits are nowhere near that of Amazon.

Walmart vs Amazon: Seller Policies

The seller policies for Amazon vs Walmart Marketplace have key differences that are important for sellers to understand.

Amazon

On Amazon, the seller policies are quite extensive and detailed. Sellers must adhere to strict guidelines around product listings, pricing, customer service, and more. For example, Amazon has strict rules around product condition descriptions, prohibited product categories, and intellectual property protections.

Sellers must also maintain high-performance metrics like low order defect rates and on-time shipping:

- Order defect rate < 1%

- Pre-fulfillment cancellation rate < 2.5%

- Late shipment rate < 4%

Failure to meet these standards can result in account suspensions or other penalties. That said, Amazon provides a wide range of seller tools and resources to help merchants succeed in selling on the platform.

Walmart

In contrast, Walmart’s seller policies, while still comprehensive, tend to be more straightforward. Walmart has clear pricing guidelines, focusing on maintaining competitive prices. Sellers must also meet performance targets for on-time shipping and order accuracy:

- 90-day order defect rate = 0-2%

- On-time shipment rate > 99%

- Valid tracking rate > 95%

However, Walmart is generally more lenient than Amazon regarding account suspensions. Walmart often works with sellers to address issues rather than immediately penalizing them. Walmart also provides dedicated account management support to help sellers optimize their performance.

Verdict: Both Amazon and Walmart have robust seller policies in place, but their approaches differ. Amazon’s policies are more stringent and complex, requiring a higher level of seller sophistication to navigate. Walmart’s policies, while still demanding, tend to be more transparent and forgiving, potentially making it easier for newer or smaller sellers to get established.

Walmart vs Amazon: Product Types

Amazon

You can sell nearly everything legal on Amazon. This platform offers an even broader array of product categories: electronics, software, books, health and household, clothing, and more. Additionally, Amazon Handmade provides a dedicated platform for artisans and craftspeople to sell their unique, handcrafted goods. As an eCommerce-focused platform, Amazon attracts a broader range of less price-sensitive customers more interested in product selection, fast shipping, and a seamless shopping experience.

| AllCategory1Amazon For SellereBay For SellerEtsy For SellerTikTok ShopMultichannel Selling404 PageTraffic Blog |

While Amazon has a vast product catalog, it also maintains strict policies around certain restricted items, which sellers must carefully review. Amazon’s diverse product types and global reach make it an attractive option for sellers looking to expand their customer base, though the platform’s high competition can make it challenging for new sellers to stand out.

Walmart

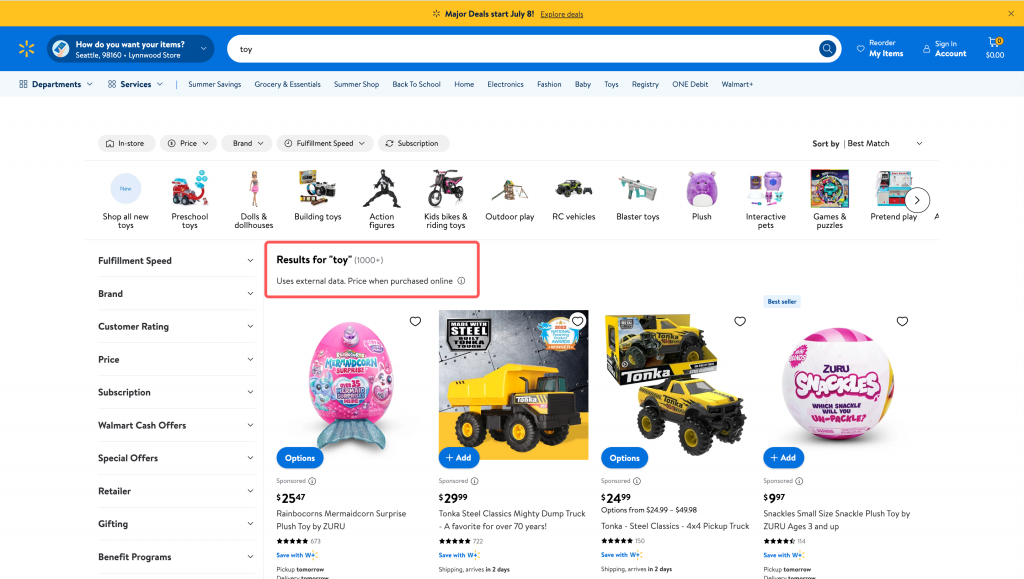

Walmart’s product taxonomy covers a wide range of 24 main departments breaking down into many sub-departments, including groceries, home improvements, household essentials, pet supplies, electronics, and outdoors. This diverse product selection appeals to Walmart’s cost-conscious customer base, who shop the platform for everyday essentials and value-driven products.

Walmart has a long list of prohibited product types, such as used, vintage, or handmade items, alcohol, and tobacco, that sellers must be aware of. The platform has implemented a granular product type classification system to help customers easily find and filter relevant products. Each product type has distinct required attributes and values that sellers must adhere to during item setup and maintenance.

Walmart vs Amazon: Shipping & Fulfillment Services

When selling on Walmart vs Amazon, you always have two options for shipping and fulfillment services.

Amazon

There are two methods of fulfillment on Amazon. You can either go for Fulfillment by Amazon (FBA) or choose Fulfillment by Merchant (FBM).

With the Amazon fulfillment center, brands can send inventory ahead for future orders. In the Amazon warehouse, the staff is responsible for picking up, packaging, and shipping orders on your behalf.

FBA sellers receive an Amazon Prime badge on their profile and enjoy better visibility in Amazon’s product search results.

The marketplace will also take care of returns, refunds, and customer support. It’s a great benefit for small and inexperienced business owners. However, it might be restrictive for well-established brands expecting to control services and return policies. Sellers desiring to fulfill orders independently can opt for Amazon Fulfilled by Merchant. Amazon offers a signing-up option to Seller-Fulfilled Prime (Amazon Prime Badge included) without being an FBA seller. However, you must consistently record on-time deliveries and exceptional customer satisfaction to register for the program.

Walmart

The Walmart marketplace provides sellers with two fulfillment choices: Walmart Fulfillment Services (WFS) and Self-fulfillment. However, Walmart Fulfillment Services (WFS) is only available to established sellers.

If you are new to the platform, you can only fulfill tasks independently. Nevertheless, you can not have branding packaging or include marketing materials. For this reason, Walmart bans sellers from using Amazon Multi-Channel Fulfillment (MCF). The platform does not acknowledge Amazon Logistics codes as valid tracking codes. If it catches you using Amazon Logistics codes, your account will receive a suspension.

As an effort to rival Amazon Prime, Walmart launched a loyalty program – Walmart+. Sellers joining the program receive free, unlimited same-day shipping on all groceries and other perks, including a scan-and-go service for in-store shoppers.

Notably, Walmart also puts forward free two-day shipping for all orders over $35. You don’t have to be a member of the marketplace to access this beneficial incentive.

Verdict: Walmart’s shipping and fulfillment services might be stricter in requirements than Amazon’s. However, if you are a US seller, you can enjoy Walmart’s fast delivery program without having a membership to the platform.

Walmart vs Amazon: Branding & Advertising

Amazon

With high competition, Amazon sellers have to invest more effort in branding activities and advertising to stand out to consumers.

Regarding branding activities, sellers can establish a good reputation with buyers by maintaining high seller and product ratings. These ratings are also the first thing buyers see when browsing seller profiles.

Sellers also have to make a positive impression on Amazon by meeting Amazon’s performance standards. Sellers failing to meet these performance standards may risk having their selling privileges removed by Amazon.Amazon offers more paid search and ad options for advertising programs than any other marketplace site. The platform provides a pay-per-click system to attract buyers at every buying cycle stage.

Walmart

As a thriving traditional retailer, Walmart is better known for all the brands it carries. Once presenting your brand on Walmart, there’s a higher chance that your business will gain a better branding impression.

In terms of IP infringement concerns, Walmart’s application process helps reduce infringement cases with rigorous requirements of ownership proof, experience, and other qualifications.

Walmart is also far less saturated with promotions than Amazon. According to Teikametrics, only 1.6% of its sellers currently advertise which indicates a lower CPC across the platform. However, with a first-price auction approach, Walmart ads may be trickier to manage.

Verdict: All in all, it boils down to market size and business budgets, that each platform stands as the first choice for sellers. Walmart might be appealing to sellers looking to build a strong brand while Amazon offers more opportunities for profit growth.

Selling on Walmart vs Amazon: FAQs

- Is selling on Walmart profitable?

95% of Walmart Marketplace vendors own profitable online stores. 73% of Walmart Marketplace vendors make profit margins of more than 20%, and more than half earn more than $100,000 per year.

- Can you sell on both Amazon and Walmart?

In fact, merchants don’t have to pick between Amazon and Walmart—they can sell on both! Indeed, 12% of current Amazon sellers are interested in expanding their eCommerce brands to Walmart in 2021.

- Which is better Amazon or Walmart?

Walmart wins the prize for low-cost grocery shopping and fresh groceries delivery. Amazon is the ideal marketplace to go for if you want a wider selection of items (including handcrafted artisanal goods), as well as a profusion of streaming services and Whole Foods Market bargains.

Walmart vs Amazon: Final Words

Amazon continues to dominate the eCommerce industry and is set to do so in the near future. However, Walmart is also catching up with various programs for sellers on their marketplace.

You might find Amazon more user-friendly than Walmart, but if you are a registered US business, there’s no reason you shouldn’t sell on Walmart. Don’t put all your eggs in one basket, as the expression goes!

With the help of LitCommerce, you can further grow your online business by selling on multi-channels. If you are interested, don’t hesitate to drop us a message.